An in-depth look at Lido Staked Ethereum

Lido’s Staked Ethereum, also known as stETH, is a digital asset representing ETH staked with Lido Finance, combining staking rewards with the value of the initial deposit. The asset was introduced in 2020, ahead of Ethereum’s transition to Proof-of-Stake. It serves as a liquid token, in which users deposit ETH into a smart contract on the Ethereum blockchain and receive an equivalent amount of stETH, which can be traded, exchanged, borrowed against, or used for any other purposes in Decentralized Finance (DeFi) and applications.

So, what’s the reason for stETH?

Firstly, it’s a matter of accessibility. The main reason for stETH is to provide a more accessible and liquid way to earn staking rewards on the Ethereum blockchain. To earn staking rewards on the Ethereum blockchain, you need to stake at least 32 ETH, which is not doable for everyone. By allowing users to put up any amount of ether as a stake, Lido Finance lowers the financial barrier to staking ETH.

Then there’s liquidity. stETH offers a liquid token that can be traded and used in applications, unlike normal staked ETH, which is locked in the protocol. This allows users to easily manage and use their staked ETH without sacrificing the ability to earn staking rewards. When staking ETH natively instead of liquid staking, these are locked into the protocol and not withdrawable or tradable until a future network upgrade.

The third aspect of stETH is transparency. When a user deposits ETH into Lido Finance to earn staking rewards, the stETH token is minted. And when stETH is redeemed, it is essentially burned (redemptions are on-hold until withdrawals on Ethereum go live). stETH token balances are issued in proportion to the ethers staked by Lido. Every day, the stETH token's balance is updated when the oracle reports a change in total stake. This happens once a day at 12 pm UTC. Users who hold stETH will not see a transaction sent to their wallet because the rewards are embodied through a balance rebase. Instead, users should see their stETH balance change automatically without any accompanying transaction.

The rebase is not limited to Lido but expands across integrated DeFi platforms such as Curve and Yearn. Therefore, if you stake your stETH across these different protocols to earn additional rewards, you will also continuously benefit from daily stETH rewards. However, since UniSwap, 1inch, and SushiSwap are not designed for rebasable tokens, you risk losing a portion of your daily staking rewards by using stETH as liquidity across these platforms.

What To Do With stETH

While Lido’s stETH is primarily designed to be a liquid staking asset that allows users to earn staking rewards on the Ethereum blockchain easily, it also has several other potential use cases.

It is important to note that these use cases may come with additional risks. Users should carefully consider the potential risks and rewards of the different applications they interact with. Some possible use cases for stETH include:

- Hodling: stETH is a convenient way to stake your ETH, so you might want to keep it around in your wallet and progressively accumulate ETH staking rewards.

- Trading: through decentralized exchanges, centralized exchanges, or swapped through liquidity pools. As stETH is a liquid token, it can be traded for ETH and other cryptos.

- Providing Liquidity: stETH can be added with ETH and other assets into liquidity pools, allowing users to exchange stETH for ETH or else as needed and allowing the Liquidity Provider to earn additional rewards.

- Lending: platforms such as Aave enable lending and borrowing of cryptocurrencies. stETH can be used as collateral for loans or loaned to others, potentially allowing the user to earn additional income.

- Yield farming: users can earn additional interest on their stETH by depositing into platforms such as Yearn or Beefy Finance.

- Other applications: stETH may be used in various applications that support the token, allowing users to easily make the most of their ETH without sacrificing the ability to earn staking rewards.

While many new derivatives and alternative DeFi solutions are coming up for stETH, it's important to remember that the more experimental a solution is, the higher the risk you take.

Look at the paragraph below if you want to learn how to liquid-stake your Ethereum.

How To Liquid Stake Ethereum

Before staking your Ethereum, you’ll need a compatible wallet such as Metamask or Ledger, and some Ethereum on it to pay for network gas fees and obviously for staking.

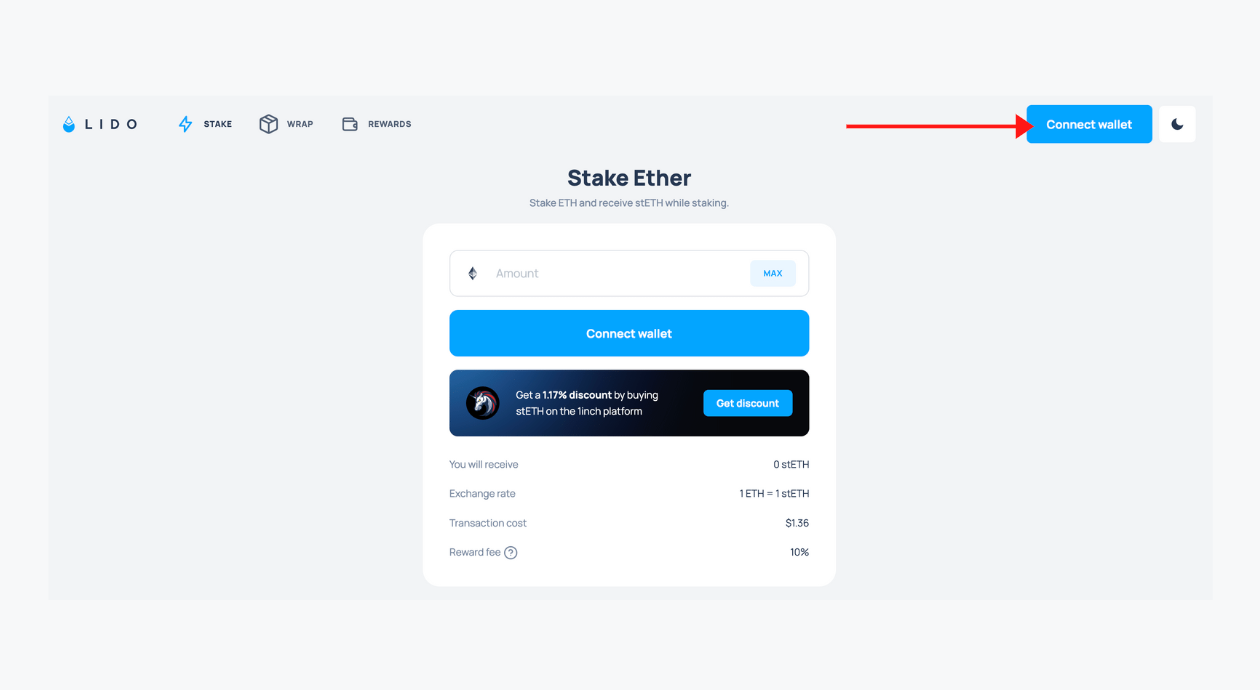

To get started with ETH staking, go to: https://stake.lido.fi/. On the top right, select “Connect Wallet”.

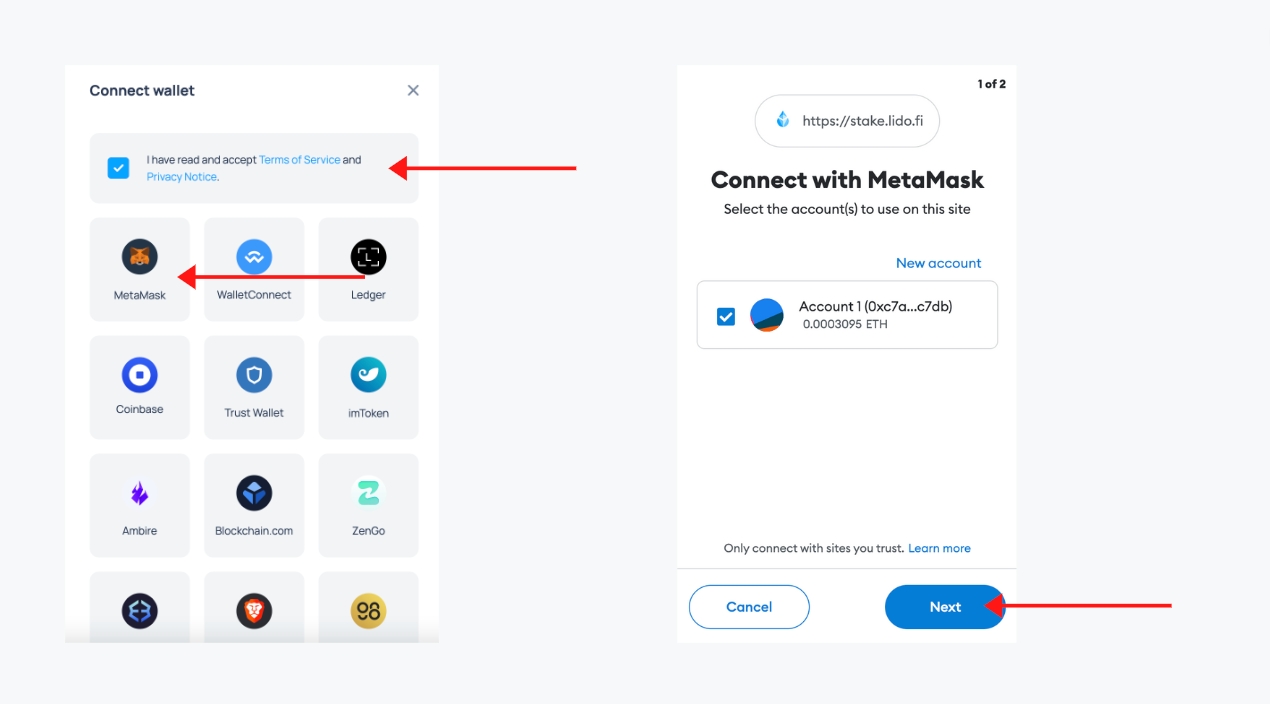

Read and accept the terms and conditions, and select the wallet of your choice. In this case, we’re using MetaMask.

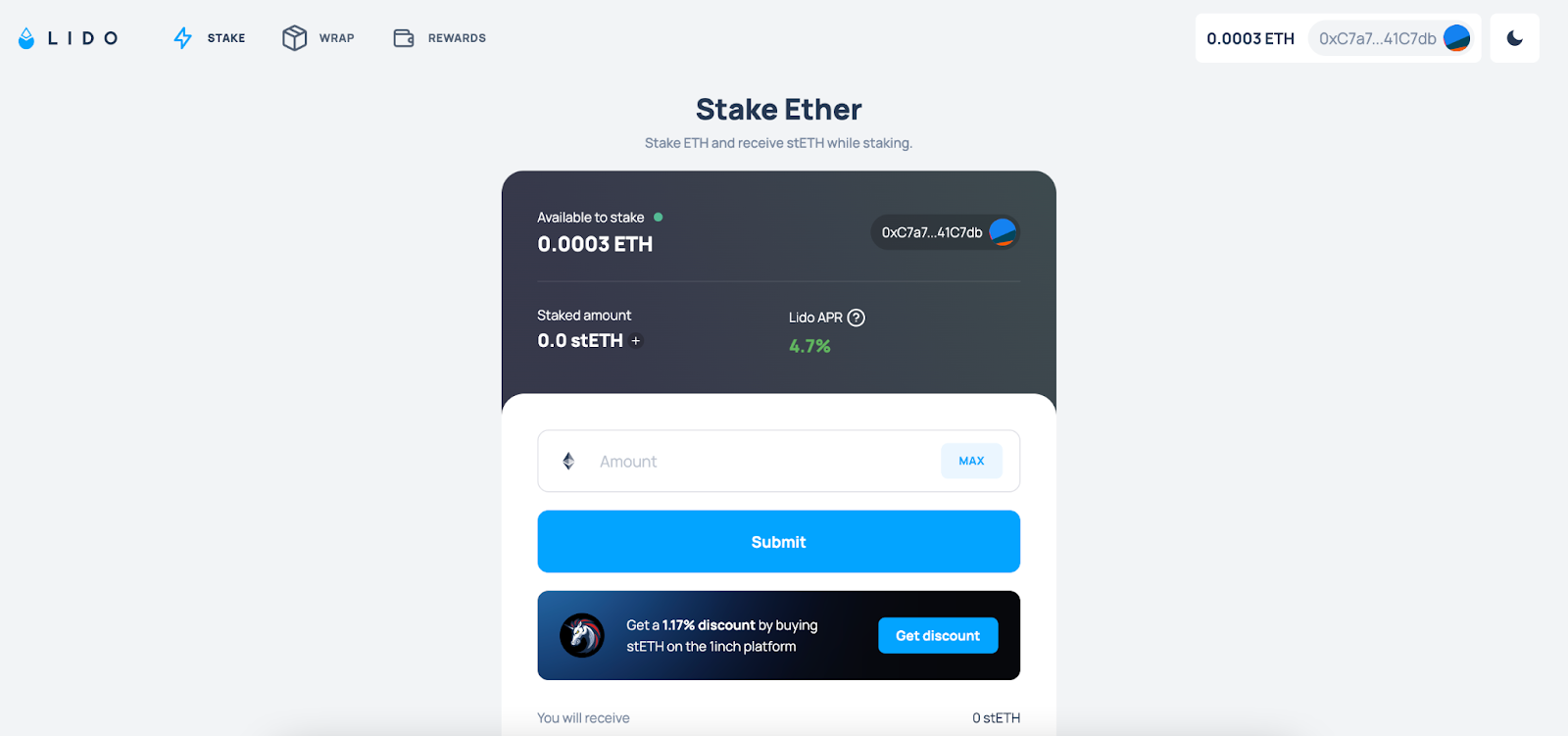

Ensure that your MetaMask or other wallet is connected to the Ethereum Mainnet, select the account, and click “Next”. Then “Confirm” to continue. Your dashboard should now look similar to the one below. In it, you’ll find the available ETH for staking, your current staked amount, Lido APR, and expected rewards.

Fill in the amount you’d like to stake, and select “Submit”. Remember that you’ll need to keep some ETH in your wallet for gas fees. In MetaMask, confirm the transaction details and select “Confirm” to continue, and that’s it.

Once your ether has been deposited, you will receive an equivalent amount of stETH in your wallet. You’re now earning stETH staking rewards. Your wallet now displays the amount of ETH you staked in stETH in your wallet. Staking rewards are reflected in your stETH balance daily. If you do not see your stETH in MetaMask, check here.

If you’d like to follow along, look at our YouTube staking guide below.

It is also possible to purchase stETH from an exchange such as Curve or Uniswap. By swapping ETH for stETH, you’re also staking ETH.

stETH Rewards

As previously mentioned, stakers of stETH will receive daily rewards through stETH balance rebases. There’s no activation period. That is because staking rewards with Lido are distributed to all stakers. All stETH holders, including new depositors, receive staking rewards through daily stETH balance rebases. This means that rebases affect all stETH holders, regardless of whether their ETH is deposited into the validator queue.

Here’s how it works. If only a portion of the Lido validators has made it through the queue, from which all existing stETH holders, including new depositors, are receiving their rewards. This results in a potentially lower initial reward rate – when compared with Ethereum – because the rewards accrued from the minority of already accepted validators are distributed proportionally to all stETH holders. You can track the validator queue to see the current status and how it may affect their staking rewards and more via BeaconScan.

Liquid staking your Ethereum with Lido can maximize your ETH staking rewards through risk diversification, MEV, and professional node operator selection. Typically when staking ETH, you operate your validators or choose only one operator. With Lido, you stake across many node operators, minimizing your staking risk. That is because staking with a single operator carries the risk of lower rewards or losing some of your staked ETH if the validator is slashed for any reason. By staking across multiple node operators, you can diversify your risk and minimize the impact of any reduced rewards or slashing events. Not only is your stake spread across various operators, but these are also based in different geographies, running different infrastructures, and using different clients (such as Prysm, Teku, Lighthouse, and Nimbus), which further enhances diversification and network decentralization.

Lido also uses MEV-boosted rewards. Here’s how that works on Lido. The MEV-Boost architecture enables validators to outsource block construction to third-party block builders. Builders create blocks from available transactions or bundles and send their bids to relays. A bid contains a value and block header without transactions. The MEV-Boost client, which is running alongside the validator, collects possible bids from relays, selects the highest-valued bid, and blindly signs it. The signed block is sent to the builder, who reveals the payload's contents and propagates the block. This process allows validators to earn higher rewards, which are passed on to stETH holders through daily balance rebases. The result? More rewards than traditional staking methods.

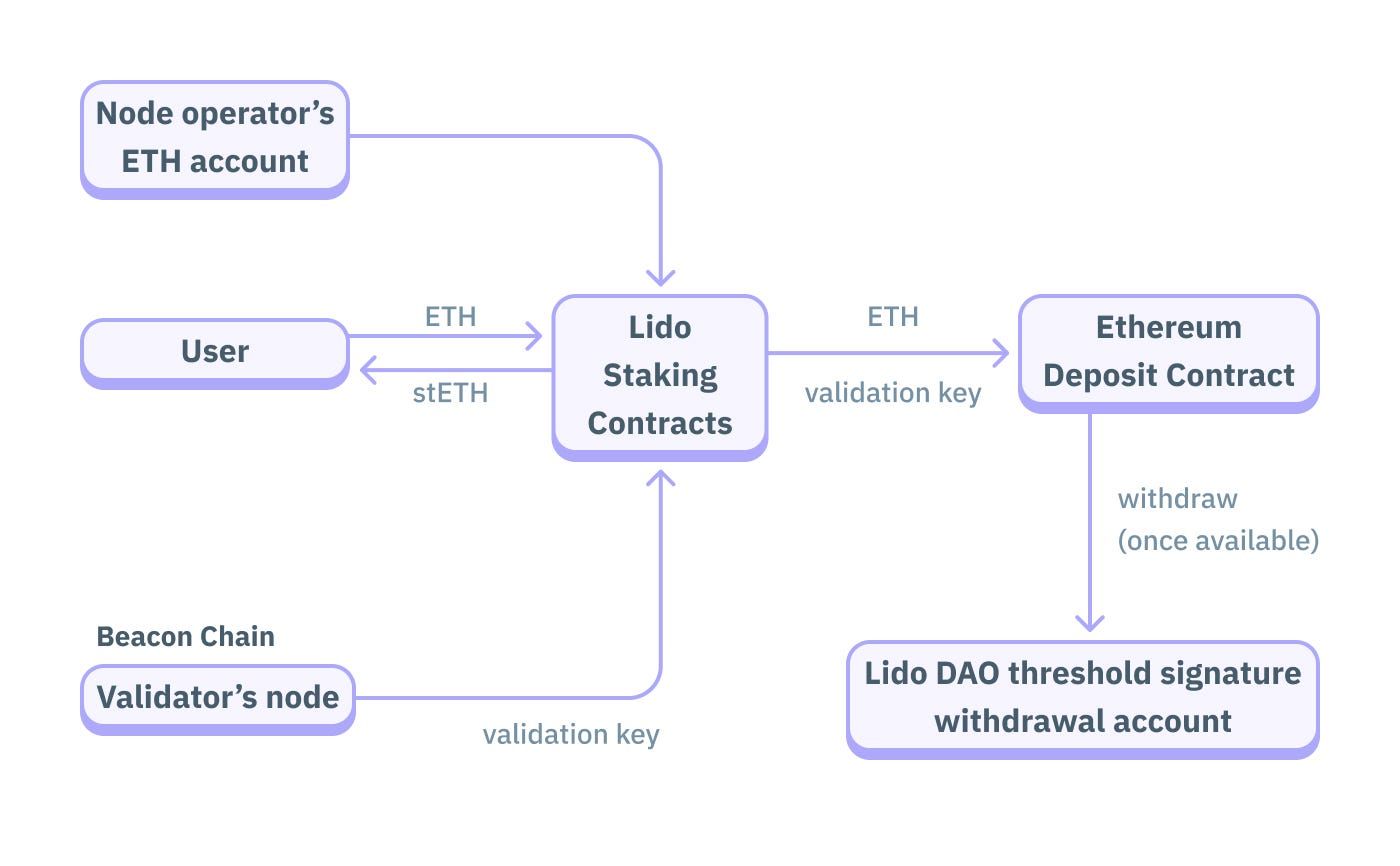

Finally, Lido carefully selects node operators to ensure reliability, performance, and risk diversification. By staking your ETH with Lido, you benefit from the expertise of the Lido DAO and Lido Node Operator Sub Governance Group to elect a set of reliable and secure node operators in different jurisdictions and locations. When a user deposits ETH via Lido, that ETH is split between node operators and sent to their respective validators.

This facilitates the overall due diligence process and node operator monitoring, as Lido carefully selects but also monitors the performance of each of its participating operators.

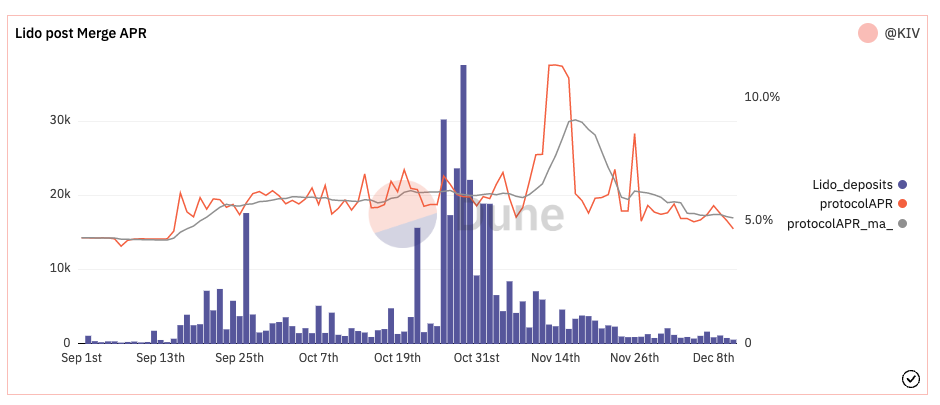

Because it all happens on the blockchain, Lido current and historical data can be tracked easily through explorers and dashboards like the ones built on Dune.

It is important to note that staking your ETH with Lido comes with risk, as the value of your stETH may fluctuate depending on market conditions. As with any investment, it is essential to research and carefully consider the risks before deciding to stake your ETH in the Lido liquidity pool. At Stakin, we are part of the Ethereum Lido node operator set, and we would be delighted to assist you if you have any questions about staking your ETH with Lido.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation