Lido's Liquid Staking solution for Polygon MATIC - Everything you should know and how to use it.

Stakin recently joined the node operator set on Lido Finance for Polygon (MATIC). Lido on Polygon is a decentralized liquid staking service for MATIC. When staking Matic through Lido on the Ethereum Mainnet, users receive stMatic ERC20 tokens representing their share of staked Matic within the Lido on Polygon protocol. stMatic can be used within the wider DeFi ecosystem on both Ethereum and Polygon, as stMatic can be bridged to the Polygon network. Also, stMATIC auto-compounds; you don’t have to manually claim and restake your rewards. Node operators, such as Stakin, play an important role in the Lido on Polygon ecosystem, providing the necessary infrastructure to ensure all staking operations work seamlessly.

Lido Finance created Lido on Polygon to promote the decentralization of Polygon, improve the staking experience and provide stakers with a wide range of DeFi use cases.

When looking to stake your Matic with Lido, you have several options, such as minting new stMatic on the Ethereum network through the Lido interface and swapping existing tokens for stMatic on Ethereum, Polygon, or other networks.

Staking MATIC on Lido

To start staking your MATIC on Lido, you will need some MATIC but also some ETH for transaction fees –both for staking and claiming rewards. Furthermore, please note that stMATIC is an ERC20 token that reflects the account's proportionate share of the total quantity of MATIC tokens within the Lido-on-Polygon system. The value of the token changes with accrued and claimed rewards and is not equal to the value of MATIC.

When you stake with Lido, you acquire stMATIC on the Ethereum network, but you can also bridge them to the Polygon network using the Polygon PoS bridge or Stakeall Finance. As a result, stMATIC is supported by a wide range of DeFi applications on the Ethereum and Polygon networks.

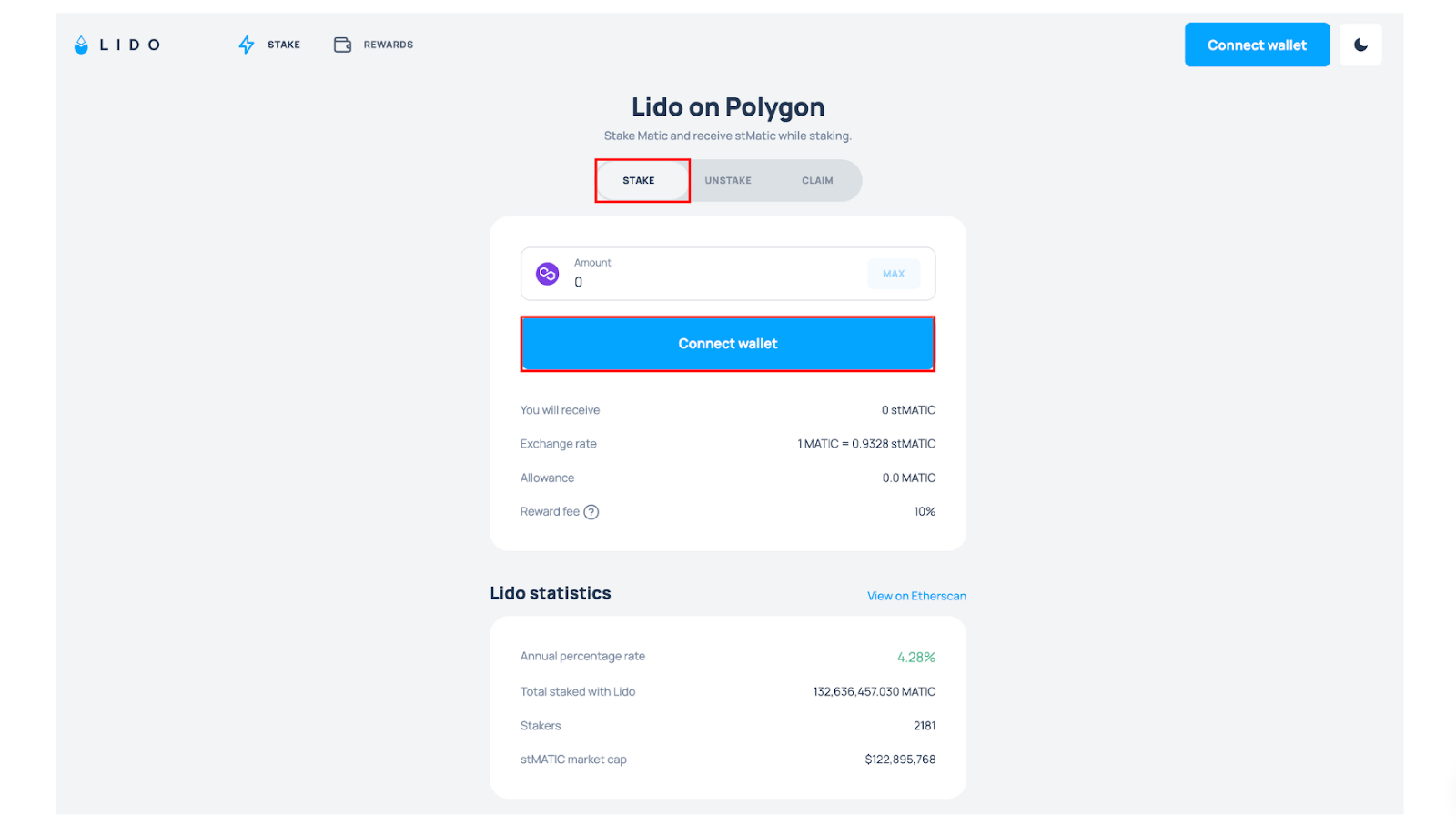

If you’re ready, go to: https://polygon.lido.fi/ to get started and select “Connect Wallet”.

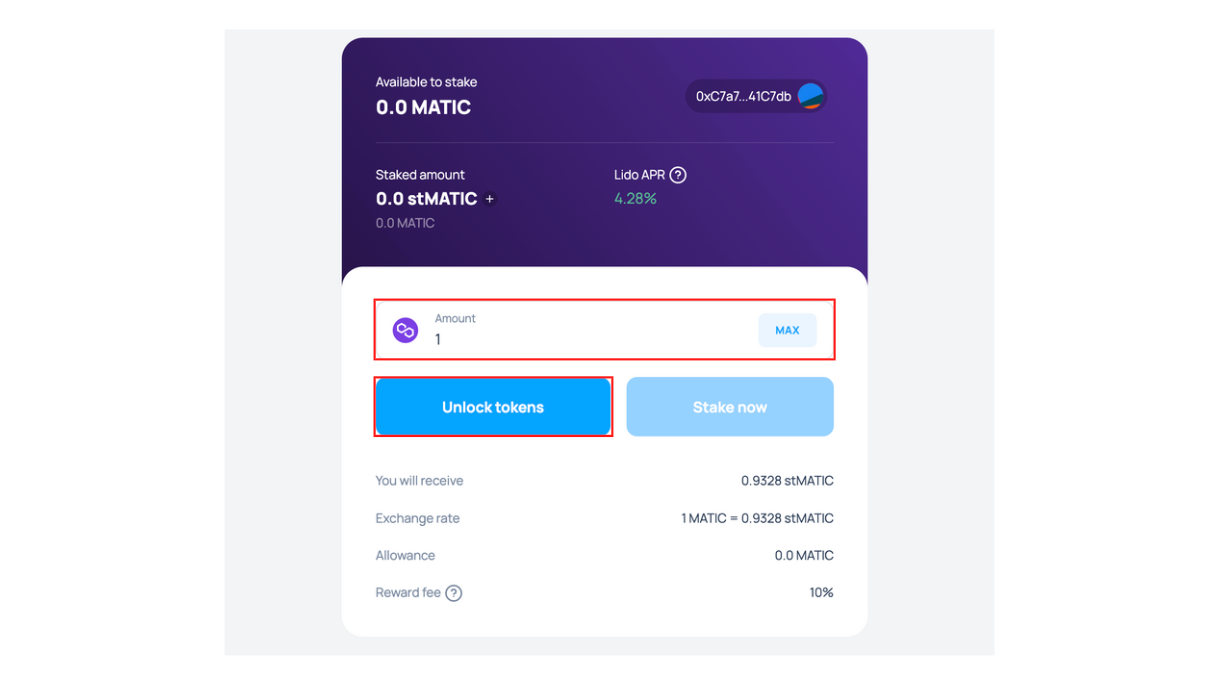

Next, you will need to unlock your assets. The unlock process allows the stMATIC contract to spend the amount to be staked from your balance. To unlock your tokens, fill in the number you’d like to unlock and confirm the transaction on the confirmation page.

Once confirmed, you will receive a message that confirms the process is complete. You can now continue with staking.

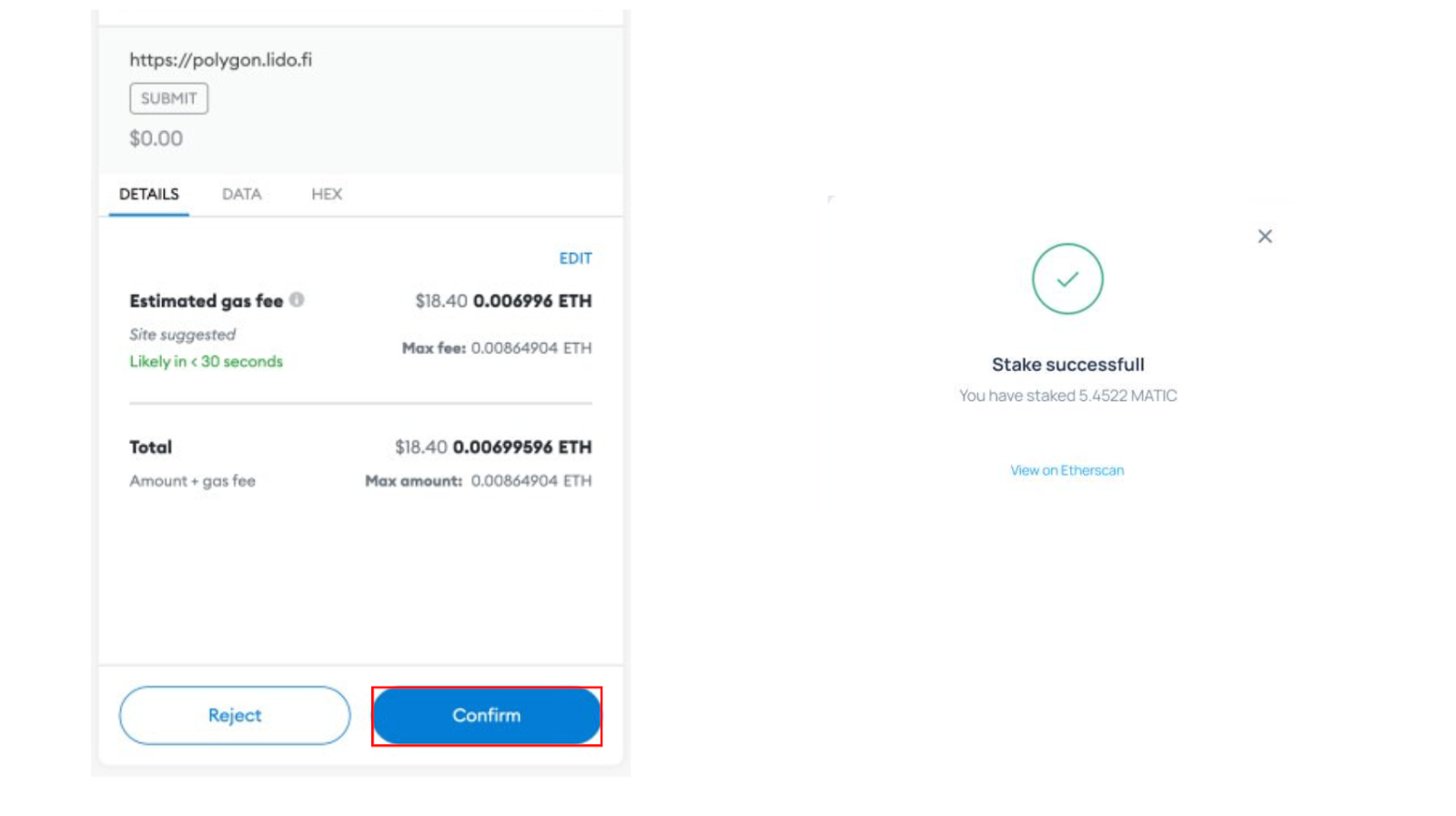

To finish the staking process, go to the app's “Stake Now” button and confirm the transaction in the confirmation screen that appears by selecting “Confirm”. In a few seconds, the pop-up will let you know if your stake was successful! And that’s all; you’ve now staked your MATIC on the Ethereum Network via Lido. As a result, you should now have stMatic in your wallet.

Buying or Swapping stMATIC

If you prefer not to stake MATIC but instead just want to acquire stMATIC for DeFi purposes, then you can either purchase stMATIC from a CEX or DEX or swap it. If you’d like to purchase from a centralized exchange, you can use the following options: Coinbase, Binance, or Gate.io. If you’d prefer to purchase from a DEX or would like to swap, you can use options like Uniswap on Ethereum or Quickswap on Polygon.

This also works both ways, as stMatic can be traded for Matic and other assets. If users are unwilling to wait for the unstaking period, they can also swap these back for other cryptocurrencies.

Unstaking or Redeeming stMATIC

Besides supporting decentralization and securing the network, the best part about staking is earning the staking rewards. To claim your stMATIC, here’s what you need to do.

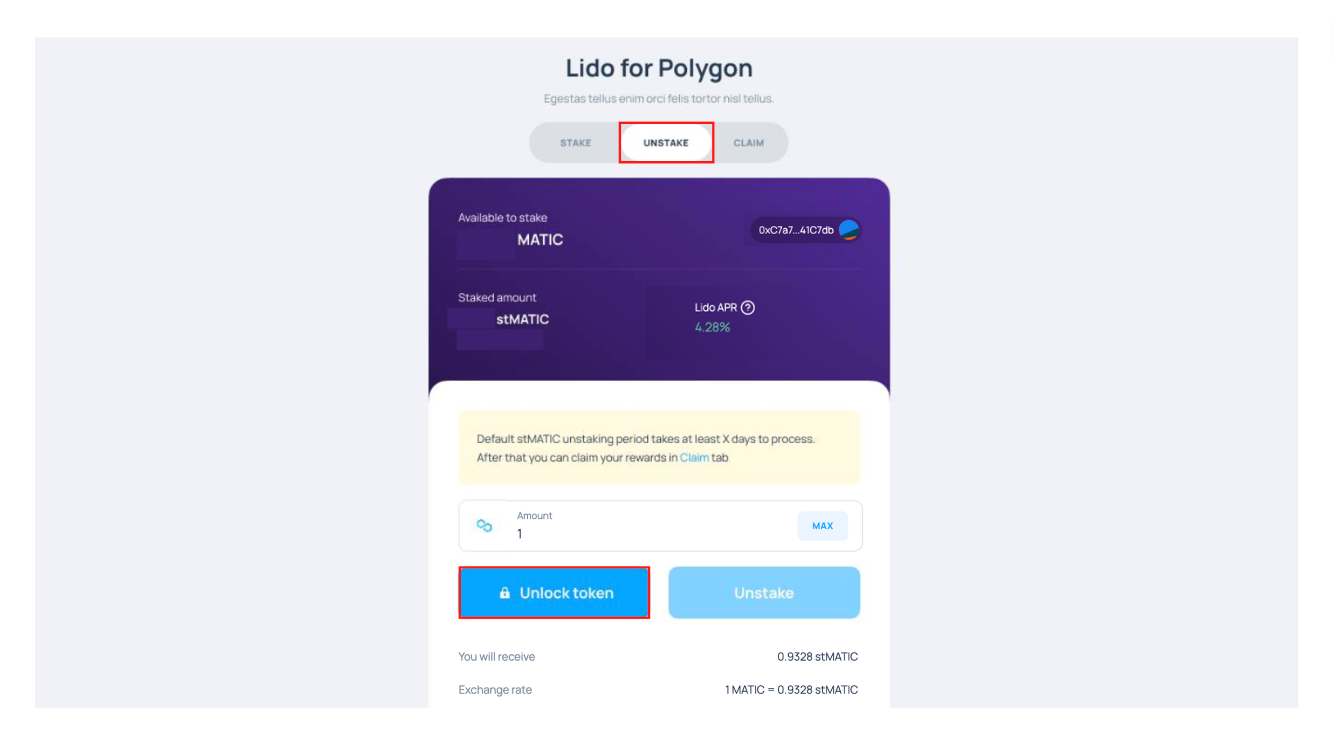

To unstake or claim your assets from the network, select “Unstake” on the Lido for Polygon dashboard and add the amount of stMATIC that you’d like to claim (see image below). Remember that the unlocking period lasts, on average, 3-4 days and up to 10 days based on the Polygon network unstaking period.

Select “unlock token” to continue. Confirm the transaction in your wallet pop-up to approve the unlocking. After a few seconds, the stMATIC will start to unlock. Now, it’s just a matter of waiting.

Once the unlocking period ends, you can fully unstake your assets. Select “unstake” on the dashboard and click “unstake” again to continue. To complete the process, confirm the transaction in your wallet. Wait a few seconds; your wallet should illustrate a “successful unstake” message. And that’s all, folks!

Please note: Upon unstaking, the user submits his stMATIC tokens and receives an NFT token as a voucher for the MATIC token claim after the un-bonding period.

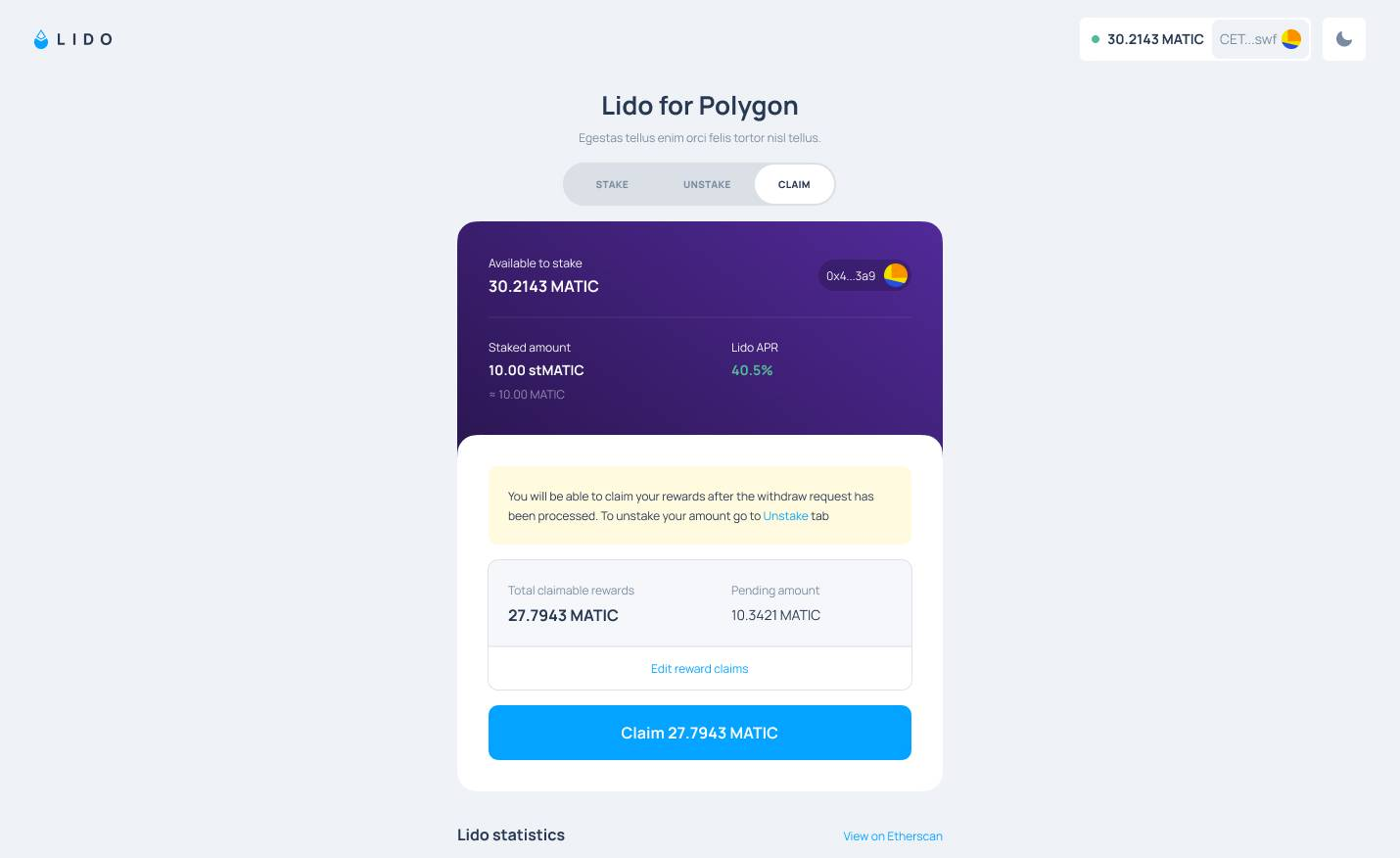

Claiming or Redeeming stMATIC for MATIC

Following the un-bonding period, a user can submit his NFT to Lido on Polygon, the NFT will be burnt, and the user will receive his MATIC. Go to the app's claim tab and press the claim button to claim/redeem your tokens.

Select “Claim” and confirm the transaction in your wallet once again. After you’ve approved the transaction, Lido will display a message saying that you’ve claimed your reward, which means you’ve now redeemed your stMATIC for MATIC and will find your MATIC in your wallet.

What To Do With stMATIC

So, you’ve staked your MATIC on Lido, and now you’ve obtained stMATIC or purchased stMATIC from one of your favorite exchanges. What can you do with it? Since stMATIC is a liquid token, many potential use cases exist. It is important to remember that these use cases come with additional risks. Users should carefully consider the potential risks and rewards of the dApps they interact with. Possible use cases for stMATIC include:

- Hodl’ing: stMATIC is a convenient way to stake MATIC, so it is possible you might want to keep it in your wallet and accumulate MATIC staking rewards.

- Trading: trading stMATIC through decentralized or centralized exchanges is possible, or you can swap through liquidity pools on both Ethereum and Polygon Mainnet (note that you will need to bridge stMATIC to Polygon first for this option). Since stMATIC is a liquid token, you can trade it for other cryptos or sell it.

- Providing liquidity: stMATIC can be used in liquidity pools, allowing you to exchange stMATIC for MATIC or another asset such as LDO. Some examples of platforms you can use to provide liquidity are Balancer and 1Inch.

- Lending and borrowing: stMATIC can be used as collateral for loans or loaned to others through platforms such as Aave.

- Other applications: stMATIC can be used in various dApps that support the token, making it easier for users to make the most of their MATIC without sacrificing earning staking rewards. There are still many new derivatives and new DeFi solutions being developed. To keep up-to-date, you can look at the Lido Ecosystem overview.

Final Thoughts

Lido Finance for Polygon is a DAO-governed protocol that offers a seamless staking experience, allowing users to effortlessly stake their MATIC tokens on the Ethereum mainnet and receive stMATIC tokens in return. By participating in staking, users earn rewards while maintaining complete control over their stMATIC tokens, which can then be used in DeFi dApps across the Ethereum and Polygon ecosystems.

Stakin is thrilled to be a node operator for Lido on Polygon. Lido is committed to decentralization, and we are proud to contribute to the diversity of Polygon users, operational locations, and infrastructure configurations. Liquid staking has many benefits, specifically regarding accessibility, efficiency, and user experience.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation