An in-depth guide to staking your $CMDX and an overview of the Comdex Ecosystem

Comdex, is a synthetic asset protocol that allows for the unlocking of a vast set of commodity debt assets and liquidity, making the flow of capital from DeFi to CeFi seamless. The protocol plays a crucial role in the overall mission of Comdex to democratize finance. Here’s why the creation of digitally tradeable representations of a wide range of assets enables investors to have global accessibility in finance.

Built with the Cosmos Ecosystem’s core fundamentals of interoperability, the Comdex ecosystem of solutions can work synergistically to aggregate liquidity from different DeFi ecosystems and facilitate the flow into CeFi (centralized finance). Synthetic assets are the foundation for fulfilling the Comdex vision and work by creating bridges to other crypto ecosystems and financial instrument markets.

Now, before we dive into Comdex further, let’s have a look at synthetic assets. What are synthetics, and how do they work? Synthetic assets are basically tokenized derivatives. In the traditional financial world, derivatives are representations of stocks or bonds that a trader does not own but wishes to buy or sell. In simple terms, a derivative allows you to profit from the price fluctuations of a stock that you do not own. Synthetic assets, also known as tokenized derivatives, take this process a step further by putting the derivative's record on the blockchain and essentially creating a digital asset token for it.

On Comdex, synthetics are tokenized derivatives that provide exposure to the price movement of real-world assets through the creation of collateralized debt. Investors can use synthetics to provide liquidity, borrow, and speculate on a variety of assets. As a result, synthetic assets are critical to our mission to democratize finance. Comdex has already developed capabilities to help SME and MSME borrowers in commodities trade gain access to trade finance.

The Comdex synthetics exchange facilitates the creation and trading of synthetic assets on-chain. Minted synthetics on the chain are called cAssets. Each commodity listed on the platform has its own unique 'cAsset' token that can be traded on Comdex's AMM module, the cSwap. The following are some of the platform's key stakeholders:

- Traders are users of the platform with the intent to profit from the movement of the prices of cAssets on cSwap.

- Minters or borrowers are users who create the initial liquidity of cAssets on the platform. These users can lock up a range of Cosmos assets to mint cAssets. The collateralized debt position (CDP) created can be closed when the user returns the cAsset debt to unlock their collaterals.

- Liquidity providers are users who intend to earn trading fees and CMDX token rewards by providing liquidity in the form of cAsset pairs to liquidity pools on the cSwap.

It is possible for users to provide long or short position-based liquidity for each listed cAsset. This system can make it easier to tokenize real-world assets than traditional derivatives markets. Investors today lack the freedom to access a diverse range of financial assets due to geographical and regulatory constraints. Creating synthetic assets allows for a continuous flow of capital between asset classes.

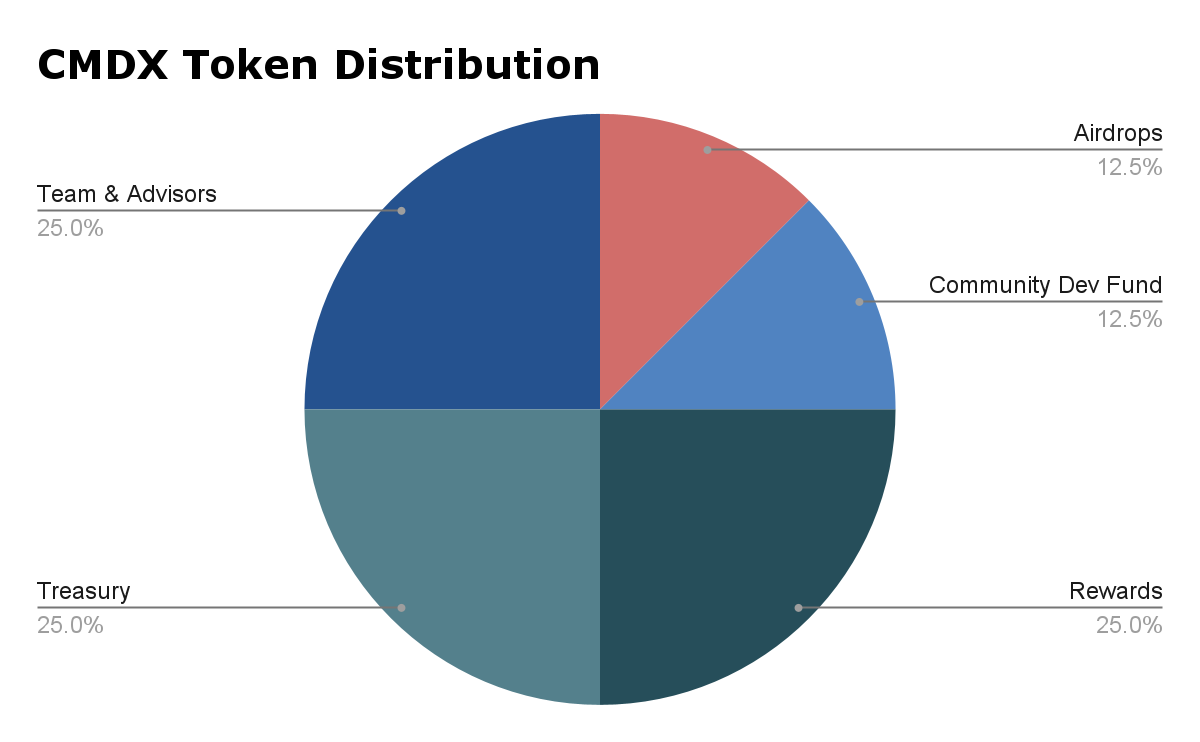

Comdex Token economics

CMDX is the Comdex chain's native token, and it will be critical in assisting Comdex in fulfilling its vision of creating an ecosystem of solutions to democratize finance. Below are the specifics of CMDX's token economics, as well as an explanation of how it will function within the Comdex ecosystem.

The CMDX token is inflationary in nature with an inflation of 30% set for the first year and a subsequent reduction of 25% in the inflation rate in each with the maximum supply capped at 200,000,000 CMDX.

- For full details on the token economies of Comdex, please have a look here.

Staking Comdex with the Cosmostation Wallet

Part 1 - Creating Your Cosmostation Wallet

Before you can get started with the Cosmostation wallet, you will have to create one. To create a web wallet, download the app in the Google or Apple Store or select download on the webpage.

Once you’ve downloaded the app, select “create”. You will now be shown the different Mainnets for which you can create a wallet. In this tutorial, we’ve chosen Cosmos (if you’d like to select another asset, the tutorial will still work the same).

Next, click on “show mnemonic” and create a pin code. Write down the entire mnemonic phrase that is given and make sure to store this phrase offline or in another secure location. Please also remember that losing your mnemonics could lead to the loss of your assets.

Then select “create wallet”. That’s it; you’ve now created your wallet. If you’d like to make a wallet for each asset, go to “settings” and then “wallet manage”. Select the wanted asset and click “create”.

- If you’d like to connect your Ledger, please check out the guide here.

Part 2 - Staking With Cosmostation

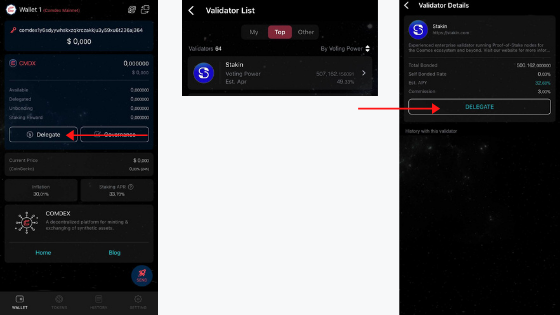

Once you’ve created your wallet, it’s time to start staking! First, send your $CMDX or other assets to your wallet by copying the address and using another wallet or DEX to send. Wait a couple of seconds, and your assets should appear on the dashboard (see image below).

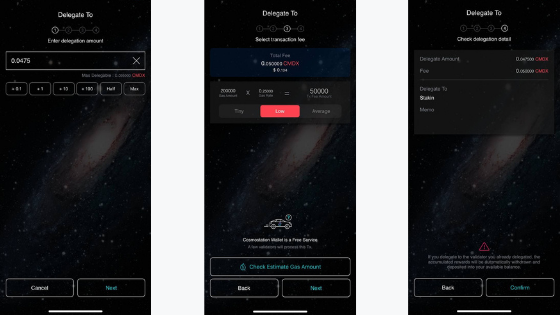

Next, on the dashboard, select “Delegate”. A list of all validators will appear; scroll down to find the validator of your choice (in this tutorial, we will be using Stakin). When you select the validator, you will see the total amount bonded, commission rate and estimated results. Select “Delegate” once again to continue.

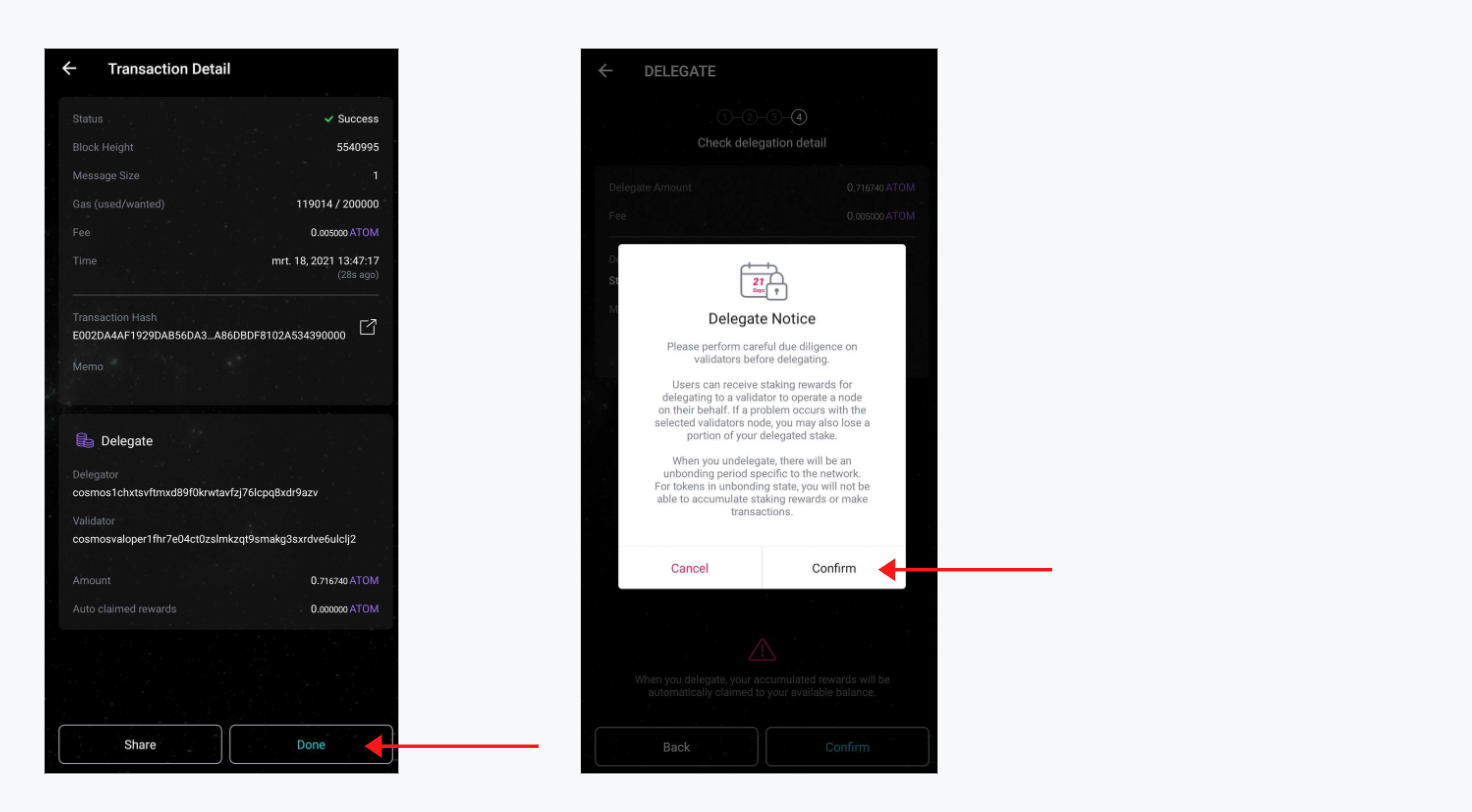

Fill in the amount that you’d like to delegate and click on “Next”. You will then see the transaction fee (gas fee), double-check the fee and select “Next”. Check all the delegation details and click on “Confirm” if they are correct.

Next, the transaction details are shown. Read through them and select “Done” to continue. Click on “Confirm” once again, and that’s it. You’ve now delegated your assets to your selected validator.

And that’s all folks! You can follow your transactions via https://www.mintscan.io/

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation