Hi Cosmos-enthusiast👩💻,

It was the hot subject of 2020 in blockchain, Decentralized Finance (DeFi) and it seems that in 2021, it is here to stay. With over 36 billion USD locked in the DeFi market (according to DeFi pulse on the 8th of February 2021), it is clear that this industry has some very attractive aspects for the Cosmos Hub. Therefore, in this article, we will tell you all about the DeFi on the Cosmos Blockchain.

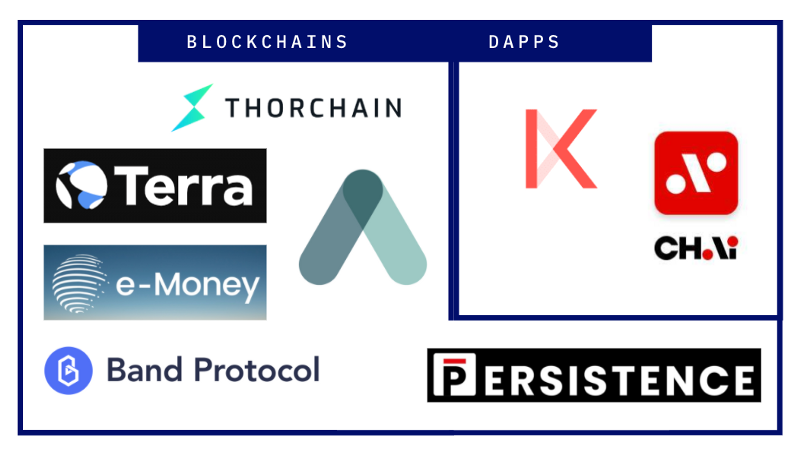

While many think of Ethereum when it comes to DeFi, Cosmos is a highly fascinating option too. What makes Cosmos so intriguing for DeFi is that it has the needed infrastructure. Terra has delivered a native stablecoin and a platform for investing, Kava, a credit market, and via Band Protocol, realizing off-chain data feeds. With Cosmos’ Inter-Blockchain Communication, the options are seemingly endless. In the following paragraph, we’ll discuss the DeFi use cases on Cosmos.

DeFi Use Cases on Cosmos

Kava Cross-Chain CDP Platform

Kava allows stakeholders of the Cosmos Blockchain to borrow money by sending collateral to a smart contract. The loans are then transferred into a stablecoin known as USDX, which is minted and loaned out. Kava has its independent blockchain. Additionally, the platform receives the economics of the Kava credit system and governance and secures the Kava blockchain by staking.

Furthermore, Kava has introduced a liquidity program that incentivizes USDX growth and distribution of Kava ownership over the users of the network. The Kava User Growth Fund receives scheduled inflation from Kava, which is used to bootstrap USDX liquidity.

- For more information about the Kava Platform, click here.

Terra Money and the Mirror Protocol

Terra Money or Terra is built on the Cosmos SDK and is a stablecoin blockchain. The difference between Kava and Terra is that the latter is modeled to scale when demand for stablecoins increases and doesn’t sacrifice the decentralization.

Interestingly, Terra has become one of the most in-demand blockchains in the ecosystem. It launched over a year ago and generated the highest daily transaction fees on blockchain apart from Bitcoin and Ethereum. The reason behind this success for customers are the discounts given, funded by the Terra treasury.

And now, Terra has introduced the Mirror Protocol. Mirror is a DeFi protocol that is powered by smart contracts on the Terra network and enables the creation of synthetic assets called Mirrored Assets (mAssets). These digital assets mimic the price behavior of real-world assets and therefore, give traders anywhere in the world open access to price exposure without the burden of owning or transacting fiat assets.

Mirror is a DeFi protocol powered by smart contracts on the Terra network that enables the creation of synthetic assets called Mirrored Assets (mAssets). mAssets mimic the price behavior of real-world assets and give traders anywhere in the world open access to price exposure without the burdens of owning or transacting real assets.

Anchor

Anchor is built on Terra Money and is a savings protocol. It offers a principal-protected stablecoin savings product that accepts Terra deposits and pays a stable interest rate. To generate results, Anchor lends deposits to borrowers who put down liquid-staked PoS assets from other blockchains as collateral. Eventually, Anchor is aimed at becoming the standard of earning a passive income with blockchain.

The key features of this DeFi system are its principal protection, instant withdrawals, and stable interest rate. Anchor has implemented a liquidation protocol that liquidates borrower collateral whenever a loan is at risk, which protects the principal of depositors. The depositing interest rate realizes the stable interest rate by passing on a variable fraction of block rewards from collateral assets to the depositor.

Chai DApp

The Chai payment DApp is built on Terra’s blockchain, and it is aiming to make retail adoption bigger, better, and more sufficient for customers. Not just blockchain enthusiasts, but also the more mainstream users. Chai is so successful that it competes with internet apps such as Korean, Kakao.

Additionally, Chai has a collaboration with BCcard, a Korean Payment Service. Through this collaboration, Chai will be launching a debit card, which was expected for early 2020 but is currently delayed.

Band Protocol

A well-known issue in the blockchain world is closing the gap between the online and offline world. The Band Protocol is a decentralized oracle solution focussed on solving that problem, while also being an independent blockchain built on Cosmos.

The native asset of the Band blockchain, called BAND, is used to secure and govern and is collateral to mint dataset digital assets. These dataset assets are staked to obtain data provider slots necessary to provide and curate data, and voting on dataset configurations such as the minimum stake needed.

What exciting about this new blockchain is the many different collaborations and partnerships they have announced over the last months. For example, on the 24th of August, they announced their collaboration with DSLA Protocol to power decentralized service level agreements on their Mainnet. Other announced partnerships are with Swipe, DForce, and Binance Smart Chain.

THORChain

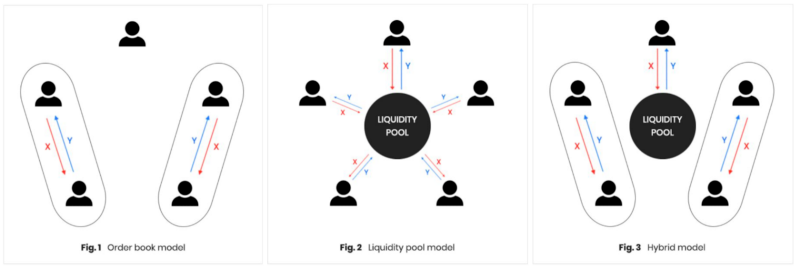

THORChain (RUNE) is a proposed automated market maker (AMM) that facilitates cross-chain liquidity pools with no pegged or wrapped tokens. THORChain will be an independent Cosmos based blockchain allowing users to trade digital assets directly for other assets without needing to issue pegged tokens. BTC straight for ETH, as an example, without needing to issue any pegged tokens.

The network is quite similar to a centralized exchange, but instead, control is given to the platform’s group of decentralized validators.

Persistence

The Persistence Blockchain is focussing on adoption aiming to is to create the most digestible ways for the adoption of Blockchain technology to help Businesses and Traders get increased access and efficiencies resulting in an increase of top-line or reduction in expenses.

The team behind Persistence believes that for the blockchain industry to scale and move from its more experimental phase to a ‘value creation’ phase, there needs to be a way to process high-value transactions, data and provide tangible results when it comes to revenue. So, that’s what this blockchain is all about.

B-Harvest

B-Harvest is a liquidity module for the Cosmos Hub, and serves AMM (Automated Market Makers) style decentralized liquidity providing as well as coin swap options. It enables you to create a liquidity pool, deposit or withdraw coins from the liquidity pool, and request coin swaps.

For those of you unfamiliar with liquidity pools, it is a collection of digital funds locked into a smart contract. Liquidity pools are used to facilitate decentralized trading, lending, and swaps

E-Money

The E-Money Protocol started in 2016, and the team has since been working on bringing innovative currency-backed tokens to the market. E-Money is an electronic payment system and store of value operating in the financial services industry. The concept and technology are developed by Block Finance A/S, a Danish Fintech company innovating new technologies that bridge traditional financial services and distributed ledger technology.

Build on the Cosmos SDK, the vision of this protocol is to provide equal access to transparent financial services on a global scale while significantly reducing costs. Its Mainnet launched in March this year and is not designed to act as a wholesale replacement for the current financial system, but instead can be used as a second layer solution.

To Conclude

More and more new Decentralized Finance projects are building every day. Blockchains invested and connected with DeFi are ruling the market and growing fast. And that’s not so crazy, since DeFi is expected to join both the offline and online world, taking Blockchain mainstream.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.