Get To Know More About Anchor Protocol and Start Earning

Hi Readers🤩,

In today’s article, we’re discussing a new and exciting network called the Anchor Protocol. What makes this protocol so unique is that it is using diversified staking yields, money markets, ANC token incentives, and governance to compose a fully decentralized fixed-income instrument. And in case you’re now wondering if that sounds too good to be true, let’s just have a look at the protocol so you can make up your mind.

Let’s start at the beginning. Over the past few years, the blockchain space has seen explosive growth in Decentralized Finance (DeFi). A wide range of financial applications covering a wide range of use cases, such as collateralized lending (Compound), decentralized exchanges (Uniswap), and prediction markets (Augur)have launched. Despite early success and a large influx of brains and capital, DeFi has yet to create a convenient and straightforward savings product with broad appeal outside of the crypto world. The savings product, Anchor, believes, is the path to mass adoption for decentralized finance.

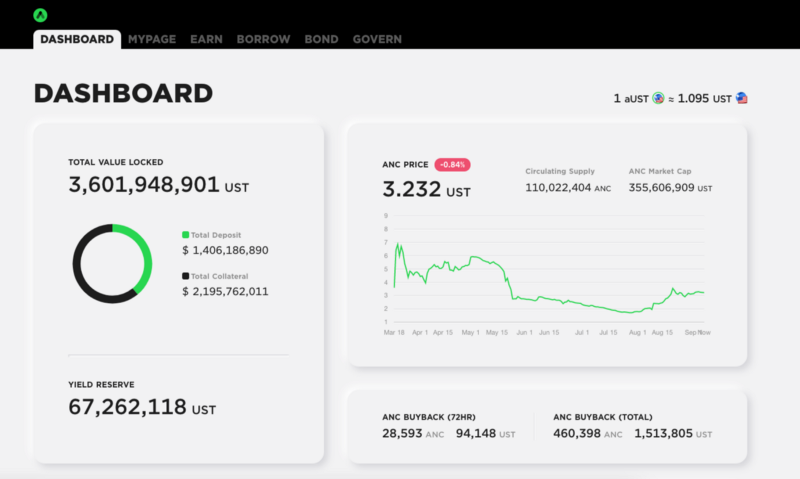

Anchor is a savings protocol that accepts Terra deposits (such as Luna and UST), allows instant withdrawals, and pays depositors a low-volatility interest rate. Anchor lends deposits to borrowers who put down liquid-staked PoS assets from major blockchains as collateral to generate yield (bAssets). Anchor stabilizes the deposit interest rate by passing a variable fraction of the bAsset yield to the depositor. It guarantees depositors’ principal by liquidating borrowers’ collateral through liquidation contracts and third-party arbitrageurs.

The Anchor protocol defines a money market between a lender seeking stable yields on their stablecoins and a borrower seeking stablecoins through stakeable assets. Borrowing stablecoins entails locking up Bonded Assets (bAssets) as collateral and borrowing stablecoins. The diverse stream of staking rewards accruing to the global collateral pool is then converted to stablecoin and granted to the lender in the form of a stable yield.

Anchor Terra represents deposited stablecoins (aTerra). aTerra tokens are redeemable for the initial deposit and accrued interest, allowing interest to be collected simply by holding on to them.

Bonded Assets

As mentioned above, in a PoS blockchain, assets are liquid, tokenized representations of staked (bonded) assets. They enable stakeholders to gain liquidity over their staked assets, allowing the locked value to be used in financial applications like Anchor. bAsset tokens are a right to the underlying staked asset position, from which staking rewards are distributed to its holders. Thus, distributed rewards can be used to incentivize the adoption of financial applications that incorporate bAssets.

Anchor Governance

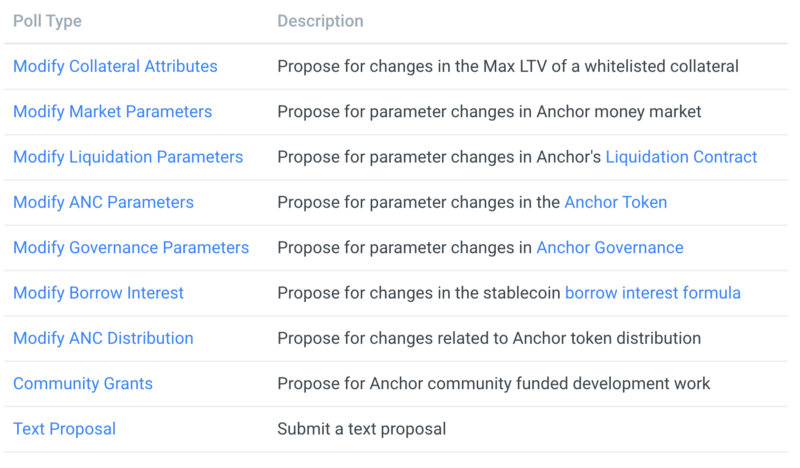

Anchor Token holders are in charge of governance. Within the protocol, the governance token is used to vote on polls. Voting power is proportional to the amount of ANC staked in the vote. Therefore, voters can allocate a certain amount of voting power in staked ANC, up to a certain amount of ANC staked. Voters with a higher ANC stake are thus given more clout in deciding whether to implement the changes listed in a governance poll.

In Anchor, new governance proposals are referred to as polls like mentioned above. There are different types of polls which can be seen in the graph below. Furthermore, what makes this so special is that all Anchor users can submit polls to be voted on. A poll can be voted on by the community once it has been submitted and until its voting period has ended. If the poll meets the quorum and threshold conditions it is ratified, and its contents are automatically applied after a predetermined time period. Note that these modifications take effect without the need for updates to the core Anchor Protocol contracts.

The Anchor Token

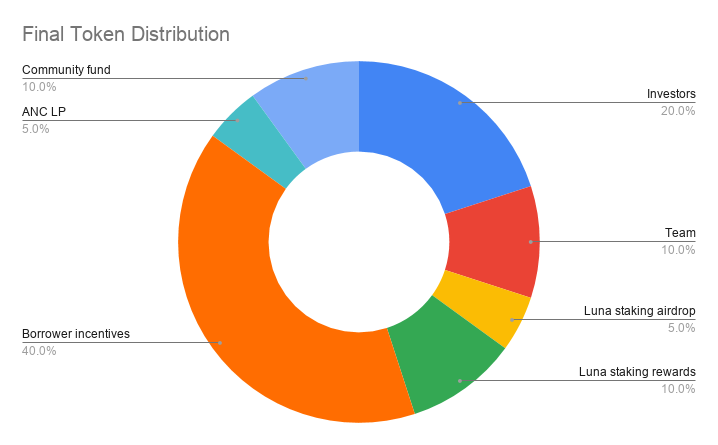

The Anchor Native Token $ANC is also, as mentioned above, the governance token of the protocol. $ANC can be deposited to create new governance polls or used to stake and vote. Furthermore, $ANC is designed to capture a portion of Anchor’s yield, thus allowing its value to scale linearly with Anchor’s assets under management.

ANC tokens generate buying pressure that grows in direct proportion to Anchor’s Assets Under Management. Protocol fees are used to buy ANC tokens from Terraswap, distributed to ANC stakers as staking rewards. A total of 1,000,000,000 ANC tokens are planned to be distributed over at least four years. There will be no more new ANC tokens added to the supply after that. The image below illustrates the token distribution after four years.

If you’d like to get to know more about Anchor, you can visit the official documentation available on https://docs.anchorprotocol.com/ or ask questions to the community https://discord.gg/9aUYgpKZ9c.

Stakin provides validator services to the Terra Money blockchain, on which Anchor is built.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation