Bringing DeFi To The ICON Network

Hi ICONists🧑🚀,

Today, we’d like to give you a quick overview of a very interesting project on the ICON Network: Balanced. It is one of the most promising DeFi (Decentralized Finance) projects on ICON.

So, what is Balanced? Balanced is a Decentralized Autonomous Organization (DAO) that incentivizes people to deposit their ICX as collateral to borrow digital assets pegged to the value of real-world assets. The very first asset available is the Balanced Dollars (bnUSD), which is pegged to the USD.

Additionally, contributors to Balanced earn Balance tokens that entitle them to contribute to the governance and earn rewards. To incentivize users to really use the platform, only actively contributing Balanced Tokens holders receive governance and reward benefits.

The distribution of Balanced Tokens works as follows: there are no pre-mined Balance Tokens available and there is also no maximum supply. In the first 60-days of operation 100,000 digital assets per day will be mined, after that, the amount will decrease by 0.50% every day until 1,250 tokens per day are reached.

Governance of Balanced is rather simple, however, it is subject to change by Balance Token holders. 66% of staked Balance Tokens must vote in favour of adjustments for the DAO’s proposals to be accepted. With its governance system, Balanced has introduced the concept of “worker tokens”. Balance Worker Tokens (BWT) are entitled to a share of Balance Token inflation, and at launch, BWT’s will be entitled to 20% of the Balance Token inflation.

BWTs can be transferred by the BWT holders or through a vote by BAL holders. There will only be 100 BWT, with the initial allocation split evenly between the initial workers: ICX Station, PARROT9, ICONosphere, and Mousebelt.

Why Balanced? As we all know, ICX and other native protocol assets are simply too volatile for payments. Look what happened to the guy who spent 13 Bitcoins on one pizza in the early days. So, by using ICX as collateral instead, it is possible to create stable assets that can be used to pay within an ecosystem.

Balanced doesn’t just offer liquidity pools; the team has also created a simple decentralized exchange (DEX) for the following pairs: bnUSD and ICX and BAL to bnUSD. The reason for this is that liquidity between sICX and ICX is vital to support the traders. Moreover, these are the things that you can do with Balanced:

- Make stable payments — borrow from Balanced to then make payments without having to worry about price fluctuations.

- Sell ICX without influencing the market.

- Leverage — through depositing ICX into balanced and then borrowing bnUSD and buying more assets.

- Provide liquidity to the DEX.

- Trade Balanced Dollars (bnUSD)

- Mine Balance Assets.

- Lastly, you can also conduct Interest Rate Arbitrage. That means that you take advantage of the 0% interest rate to borrow bnUSD and sell it for an Ethereum stablecoin. Then you can lend it at a higher rate using the Ethereum DeFi ecosystem.

Liquidity Mining With Balance

Balanced also offers a Decentralized Exchange (DEX) and offers liquidity mining. To qualify for liquidity mining rewards, users need to provide liquidity into the incentivized pools on the DEX. Balanced’s provided liquidity is used to offer a price available on both sides of the trading pair. The price offered by the pool is based on the ratio of assets within the pool. This is different from other order books, where traders place a specific limit order at a specific price. The number of mining rewards earned by liquidity providers is calculated through the following formula:

Liquidity Mining Rewards = (Provided Liquidity/Total Provided Liquidity) x BALN allocation to the specific liquidity pool.

How To Use Balanced

If you’d like to use sICX, borrow Balanced Dollars, swap assets, or supply liquidity, you can now do so by signing in to the Balanced App. Let’s have a look at how the app works.

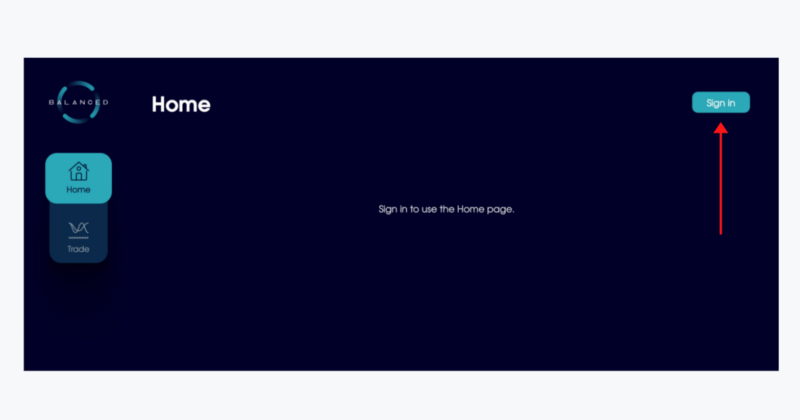

To start, go to the Balanced App: https://app.balanced.network/.

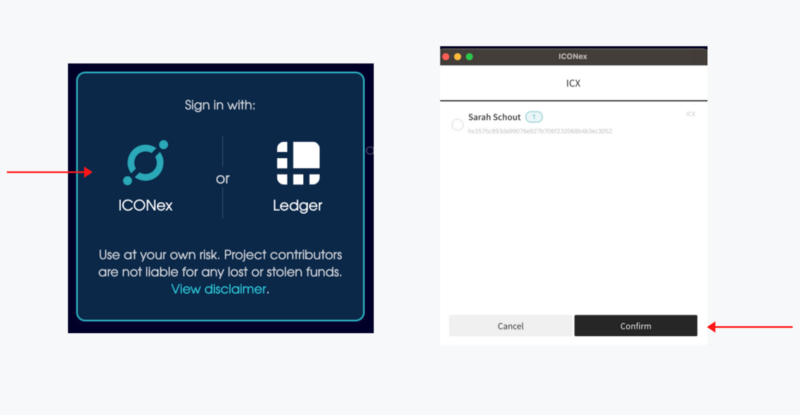

Select “Sign in” on the top right corner of the dashboard (see image above). Next, select if you’d like to connect with Ledger or with the ICONex wallet. In this guide, we’ll be using the ICONex wallet. Select “ICONex” by clicking on the logo. A pop-up will appear asking for you to confirm the connection; click “Confirm”.

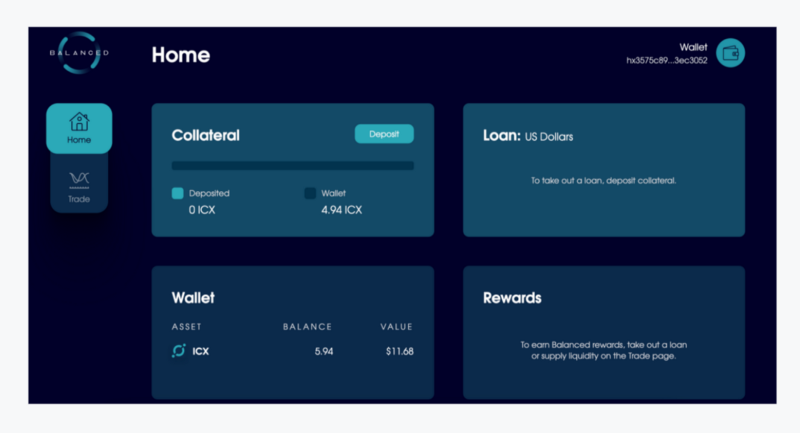

Once connected, the dashboard will automatically open (see image below). Now, if you’d like to take out a loan, you will need to deposit collateral. On the dashboard, select “deposit”.

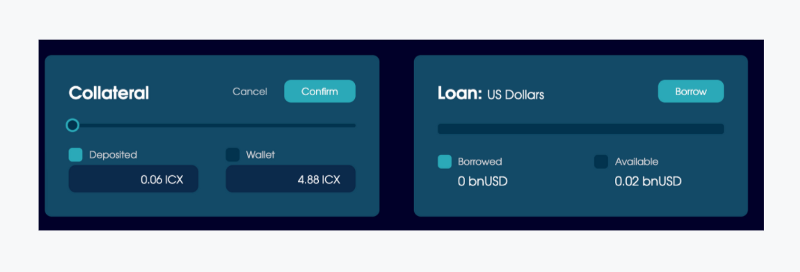

Fill out the amount you would like to deposit by moving the slider (see image below). You’ll automatically be shown how much you can take out as a loan when you do so. Next, select “confirm” and fill out your password in the pop-up to continue. Once confirmed, click on “borrow” to take out your loan.

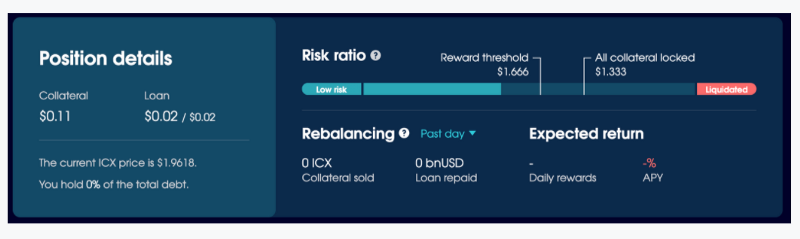

When you take out the loan, you will be shown all the position details such as the risk, reward and all the collateral locked in total.

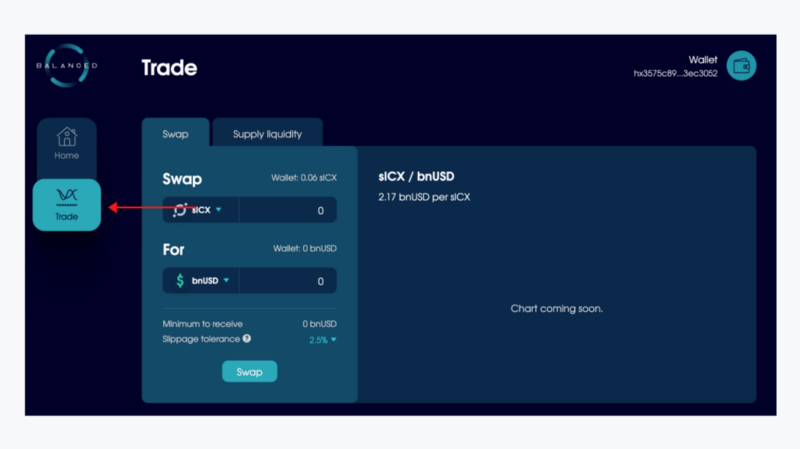

If you want to swap or supply liquidity, select “trade” on the left side menu in the dashboard.

The swapping function is very straightforward. Fill out the amount and asset you’d like to swap and what you’d like it to swap for. Select “swap”, confirm the transaction, and that’s it!

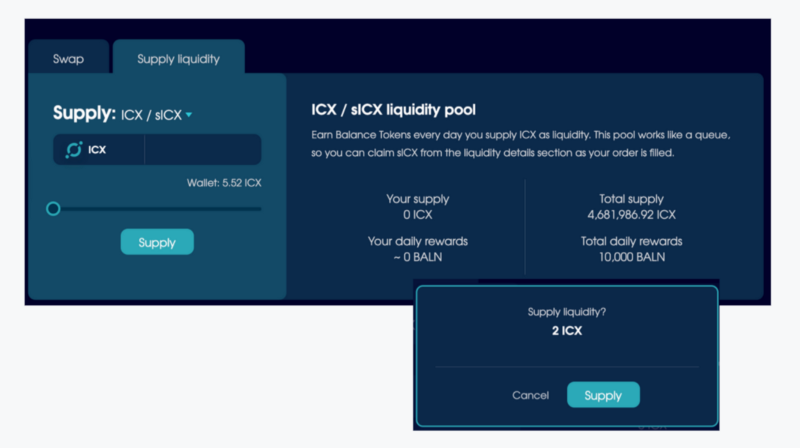

To supply liquidity, first select which asset you’d like to supply. In this case, we’ve selected ICX/sICX. Fill in the amount that you’d like to supply and select “supply”. A pop-up will appear asking you to confirm.

Please keep in mind that for this guide, we used 2 ICX. However, the minimum amount of ICX that needs to be supplied to join is 10.

When supplying, you will see how much the total supply and total reward are daily. You’ll also be able to see how many daily rewards you will earn by supplying.

And that’s it! Have a lot of fun, and of course, keep in mind that supplying liquidity, borrowing and swapping all come with a risk. Make sure to do your research before using the Balanced DAO app.

Side note: on the 2nd of May, 2021, the first airdrip of Balanced will go live. Have a look here to find out what you need to do to be eligible to receive some Balance Tokens.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation