Overview of the Kusama Network and a guide to claiming KSM tokens and nominating validators.

Introduction to Kusama ($KSM)

Hi Readers👩💻,

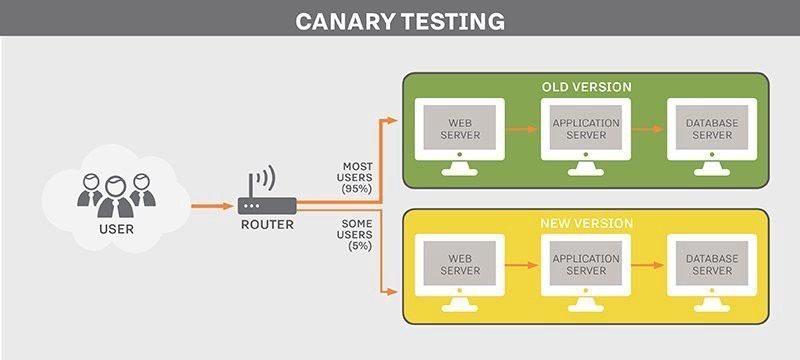

Today, I’d like to give you a quick introduction to Kusama, Polkadot’s canary network.

🐦 What Is Kusama?

You might have heard about the Polkadot network — Kusama is an unrefined, experimental version of it. Kusama works as a proving ground, allowing teams and developers to build, deploy or try out governance, staking, nomination and validation functionalities in a real environment.

Kusama refers to itself as a canary network, meaning it is meant to look-out for the Polkadot network. Warning for issues to keep everything safe for the developers down the chain. Important to note is that the Kusama network isn’t economically centralized and, therefore, it doesn’t have a kill switch: it acts as a decentralized Mainnet network. The Kusama network is intended to exist as long as the community maintains it, allowing space for new high-risk functionalities and projects.

So, what’s the importance of a network like Kusama for the development of Polkadot? Simple, the builders behind both networks hypothesize that without having implemented a network like Kusama, there wouldn’t be any reasonable way to completely understand the potential dangers that lie in the development of Polkadot.

A question often asked is whether the Kusama network will eventually merge with Polkadot. The answer to that question is simply: no. The Kusama network is a completely different network, and eventually, it will evolve into an experimental testbed for projects and concepts. Although, in the future, it might become a para relay chain interacting with the Polkadot network, i.e. a relay chain that attaches to the main Polkadot relay chain.

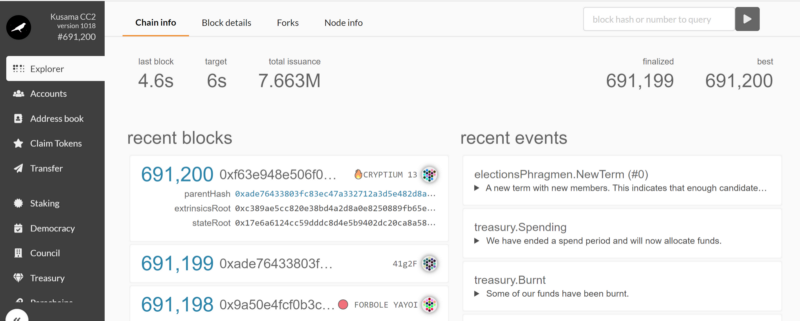

🕵️♂️ Nominated Proof-of-Stake

The Kusama rollout was a soft launch and started with a Proof-of-Authority consensus, that had validator notes run exclusively by the Web3 Foundation. During this period, most of the functionalities were limited to usage of the Staking Sessions, Claim Modules (specifically bonding, nominating and issuing the intention to become a validator), setting up session keys and claiming KSM. The period was aimed at giving at 50 to 100 well-backed validators the time to be bonded and ready. This period is also referred to as the “Sodu-module”.

After this period, the Genesis governance was introduced and Kusama transformed from a centralized Proof-of-Authority network to a decentralized Proof-of-Stake network. Further development of the consensus, has turned Kusama into a Nominated Proof-of-Stake network. So, how does Nominated Proof-of-Stake (NPoS) work? Firstly, within this consensus token holders can nominate up to 16 different validators. Each validator gets the same KSM tokens as rewards, this is not dependent on their rank. Next, rewards are proportionally distributed to the nominators. For a more in-depth technical explanation of NPoS, check the Web3 Foundations article here.

👨💼Kusama Governance

The initial Genesis Governance system of Kusama is a tricameral model. The legislative chamber (referendum chamber) has the broadest membership of all three and is by far the most powerful. All legislation, and thus, changes to Kusama’s logic, must have the approval of this chamber. This happens through an assembly of all stakeholders, weighted according to their amount of KSM held and the amount of time they are willing to continue to hold those tokens.

The other two chambers are the council and the technical committee. The council’s membership is a proportionally representative approval vote by token holders, weighted by the number of tokens controlled. The technical committee is created according to a single vote for all teams that have successfully and independently implemented two halves of the Kusama protocol. The voting time on proposals is 28 days, and an extra 30 days are added before the changes are implemented. With a 100 percent turn-out, no legislation can pass without at least 50% of the votes in approval.

After the launch of Kusama and Polkadot, Post-Genesis Governance has been put into place. With this change, two extra mechanisms will be added, these are known as the Oracle Committee and the Spontaneous Subject Committees.

The Oracle Committee is a group for which membership is controlled by the members themselves according to a set of rules, somewhat like a constitution. The members of the Oracle Committee are asked, and paid, to vote explicitly. They are also expected to evaluate statements and provide answers about them.

The Spontaneous Subject Committees are designed to be a more agile way of capturing stakeholder sentiment, which can be used to optimize the legislative flow. In a nutshell, it uses statistically significant random sampling of the stake-weighted voting population to determine the chance of a rejector or a landslide referendum approval. If the rejection is approved, proposals may be dropped.

💰 Kusama Tokens

KSM is the native token to the Kusama Network. Obtaining KSM is quite simple. If you’ve acquired DOTs token at Polkadot’s ICO, you are entitled to claim an equivalent amount of KSM on the Kusama Network. The reason being, that this way the Kusama network is aligned with the existing DOT holders and community. After Genesis, you can only claim KSMs by singing a message with the Ethereum that holds your DOT indicators tokens.

How to claim $KSM? 🤑

If you participated in the Polkadot ($DOT) token sale, you will be able to claim the same amount of Kusama tokens. For example, if you bought 2,000 $DOT, you will receive the equivalent in KSM tokens.

If you did not participate in the fundraising, a faucet should be available once transfers are enabled: https://guide.kusama.network/en/latest/start/faucet/

In this tutorial, we will use Polkadot UI, but note that there are several other ways to create a Kusama address:

- Subkey

- Enzyme wallet (Chrome only)

- Polkawallet

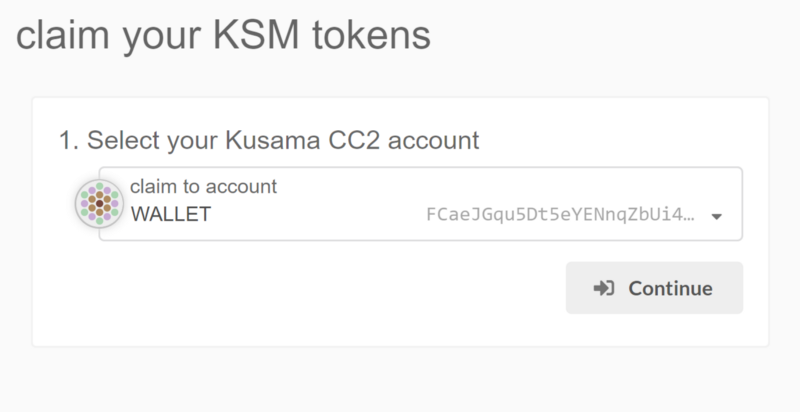

To claim your KSM tokens, you first need to create a Kusama account.

Once your account is registered & your private key secured & backup, you will now be able to claim your KSM tokens.

To claim them, simply go on “Claim Tokens”, and select your wallet where you want to claim your tokens.

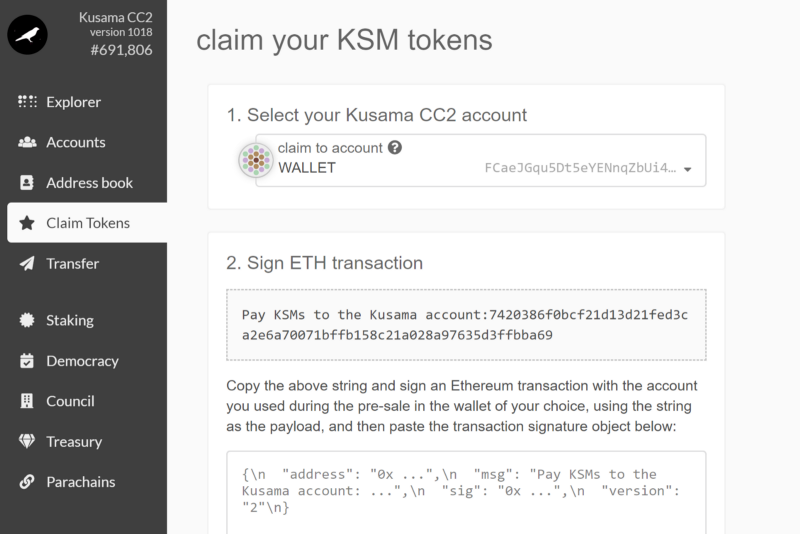

Click on continue. Now you need to sign the transactions with the wallet you used during the Polkadot token sale.

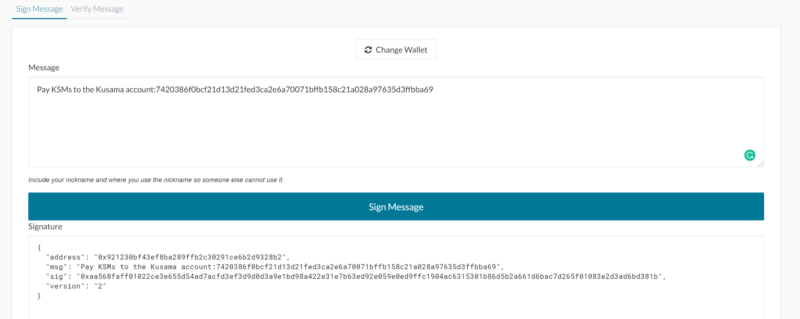

To do this, we advise to use the Sign and verify tool from MyCrypto.com.

To sign the transaction, simply connect yourself to the website, and copy & paste the message “Pay KSMs to the Kusama account: XXX”.

Click on Sign message and approve the transactions on your wallet.

Then you just have to copy & paste the signature into Polkadot UI and redeem your KSM tokens.

Tada! 👏 You have now claimed your tokens and can enjoy the staking functionality.

How to acquire $KSM? 💰

Although KSM was not initially meant to be listed on exchanges, the law of the market seems to have decided otherwise for these.

If you did not acquire DOTs on time, have not been involved in Kusama’s development or just did not receive any, you can still acquire KSMs on a few exchanges as listed here.

However, please note that none of these exchanges are endorsed by the Foundation, or by ourselves 😀. Plus, Kusama is a very chaotic network.

How to nominate a Kusama Validator? 🗳️

Now that you have claimed your KSM tokens, you will be able to stake them and/or vote in on-chain governance.

Before nominating a Validator, it’s recommended to create an additional account for more security.

To do this, simply go in “Accounts” and select “Add Accounts” to create a new one.

Once you have done this you will have two accounts:

- Stash account

- Controller account

The stash account is used only to hold some funds while the stash account is where you’ll manage your nomination.

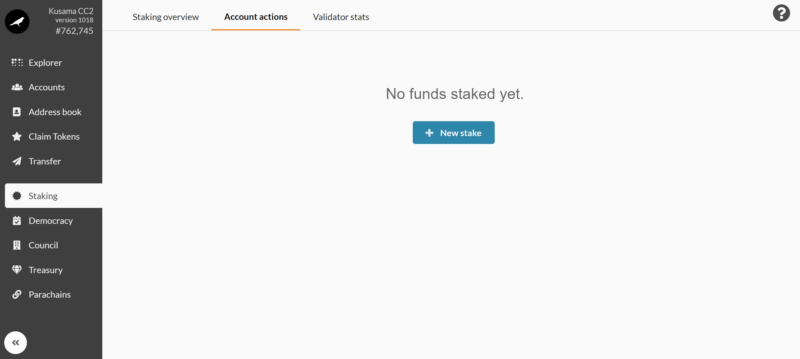

Once this is done, go directly to the Staking page on Polkadot.js.org and then go on “Account actions”.

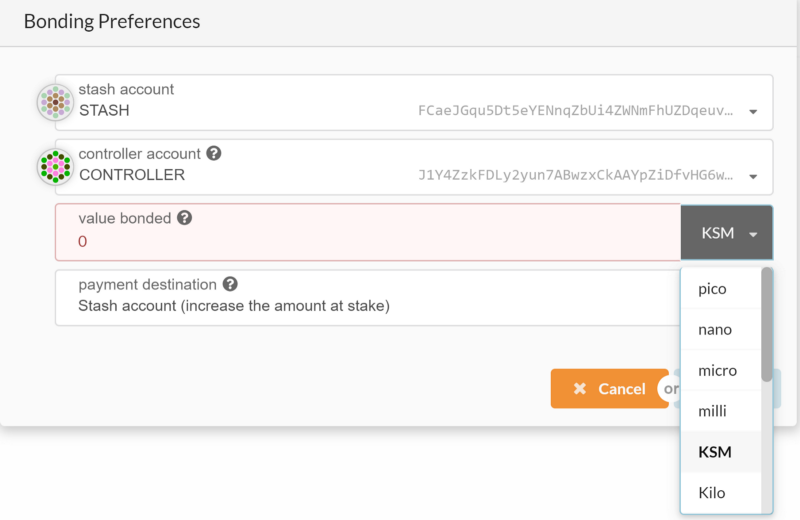

Click on “New stake” to choose your bonding preferences, distinguish the stash & controller account, choose the value you would like to bond (don’t forget to check it’s $KSM and not another $DOT token) and finally select the payment destination.

Once you click on “Bond”, the network will automatically bond your $KSM and you will be able to nominate up to 16 different validators such as ourselves!

If you want to find more info about how nominated proof of stake is going to work on Polkadot, click here.

As we’ve mentioned several times, it’s important to do your own due diligence before selecting a Validator, because you can be slashed if someone you are nominating is committing an offense (double signing, downtime…).

If you don’t want to let the algorithm allocate your funds to several validators automatically, you can also nominate and delegate the amount you want manually.

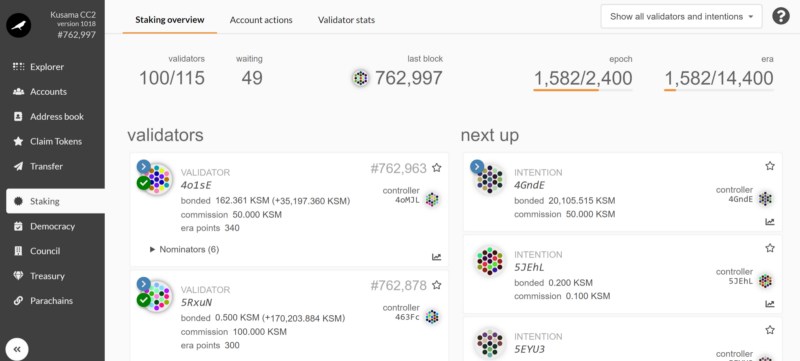

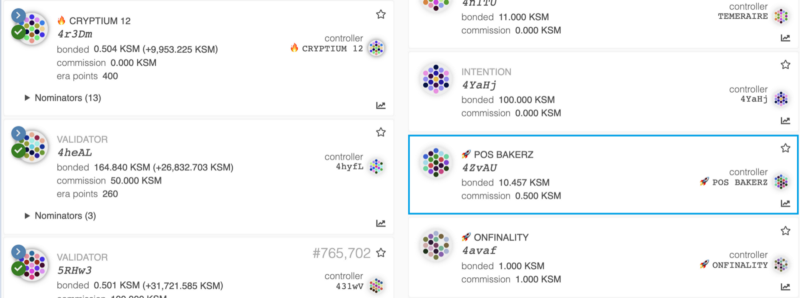

To do this, go to the staking overview page.

On the left column, you can find the current set validators. These are already elected by the community.

On the right-hand column in the list that’s called “next up”, you will see all of the validators that have mentioned their intention to operate validators on Kusama and are not yet elected.

Pick one (or more) validators to nominate and copy their address by clicking on the icon.

Then, return to the “Account Actions” page and click on the “Nominate” button to fill the blank field with the address of the validator you have chosen.

If you can’t find us on the list and still want to delegate to POS Bakerz, you can also add our Validator by simply entering this address in the blank field.

D8rBgbN7NWa4k9Wa5aeupP2rjo6iYoHPTxxJU5ef35PUQJN

Sign and submit the transaction, and you are now nominating!

For contributing to the Kusama Network, the Polkadot Genesis has reserved one percent of DOT tokens, as an incentivization grant to Kusama’s stakeholders and community. You can find more information here.

More Information and Sources

- Kusama Network Website

- Kusama GitHub

- Kusama Official Telegram

- Polkadot Website

- Polkadot and Kusama Medium Blog

DISCLAIMER — This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation