Get yourself familiar with all the different variants of PoS.

The Proof-of-Stake Guidebook

Hi Readers,

For those of you who are already familiar with Proof-of-Stake (PoS), we thought it would be interesting to shed a light on its variants. 🙌

Part 1 — Proof-of-Stake

Now, for those that aren’t that familiar with Proof-of-Stake (PoS), let’s take a look at what it is first.

PoS is often described in comparison to Proof-of-Work (PoW) and is a process through which network validators are incentivized based on the number of tokens they own.

PoS was first introduced in 2012 by Sunny King. The mechanism elects stakeholders to validate transactions. In PoS the creator of the next block is chosen through a lottery process. In reward for the creation of new blocks, digital assets are rewarded and added to the network. In PoS, the amount of staked tokens is what secures the network, unlike in PoW where the computing power protects the network. At Stakin, we’re very bullish on the future of Proof-of-Stake cryptocurrencies, as we believe that it offers the following pros:

- Less computing power-intensive than PoW: we run a few staking nodes on various PoS protocols, and to do so we only have a few secured VPS vs. tons of mining rigs for PoW miners.

- Token Holders can earn rewards/interests based on the inflation rate; this can help in the build-up of the community, but also incentivize people to hold on to their token.

- Decentralization: depending on which kind of PoS the protocol has adopted, the network can reach full decentralization, which is the initial reason why cryptocurrencies were created.

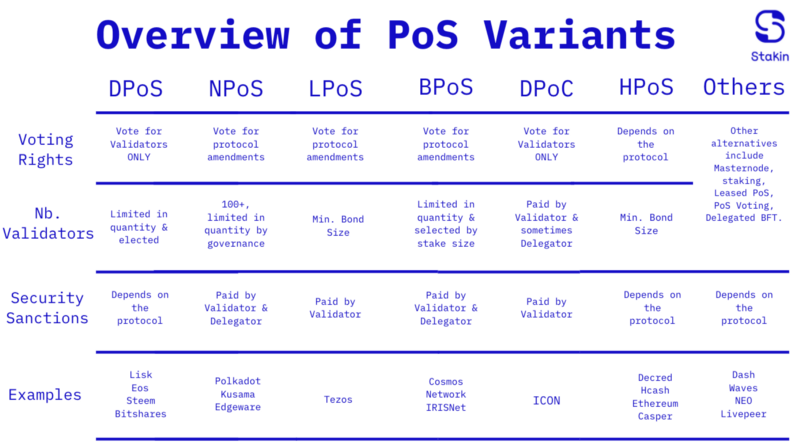

In the following sections, we will introduce you to various PoS variants, detailing how they work, and then provide you with a simple recap table. For simplification purposes, a validator designates the nodes that secure and verify transactions on the network in exchange for token remuneration. Depending on the protocol, these can also be called block producers, witnesses, or bakers.

Part 2 — The Different PoS Variations

Delegated Proof-of-Stake (DPoS)

DPoS usually works through an election system, in which a fixed number of validators are authorized to secure the network. As a token holder, you get to vote on who will validate transactions on the network, with voting power determined on the size of your stake 🐳 > 🐟. The validators with the most votes get to become delegates, validating transactions, and collecting rewards for doing so.

DPoS has been implemented on protocols such as Lisk, Tron, Steem, Bitshares, or even EOS, a scalable blockchain Dapp platform founded by Daniel Larimer and mostly known for its record year-long $4bn ICO 💰. Depending on the protocol, DPoS can require significant computing power for the validator.

Delegated Proof of Contribution Protocol (DPoC)

Some of you might be familiar with the ICON Network, the Proof-of-Stake blockchain introduced a protocol that directly rewards nodes and delegates with their native cryptocurrency. The protocol is called Delegated Proof-of-Contribution. In many ways, it is similar to DPoS, but the incentive is set-up in such a way that community member really have a strong interest to contribute to the development of the protocol

In DPoC, delegation, which is called voting, is optional and non-custodial. Additionally, it is possible to stake your tokens without necessarily voting for a node operator.

DPoC is a decentralized and democratic governance protocol in which token holders exercise their right to governance through delegating stake to those that contribute directly to the network: Public Representatives (P-Reps). There are 22 elected Main P-Reps, and no limit on the number of Sub P-Reps, who are also incentivized to contribute. Additionally, grants are given to other kinds of ecosystem participants and Dapp builders.

In case of serious downtimes, P-Reps and their voters are at risk of slashing, with a potential 6% penalty at the moment.

DPoC is still evolving very quickly and keeps on improving. As a P-Rep, we are ourselves involved in the development of the next iterations of the protocol, and supporting the IISS 3.0, which could bring DPoC closer to LPoS (with bond requirements), while still incentivizing participants with, in the case of DPoC, a decentralized grant system for builders! 🚀

Liquid Proof-of-Stake (LPoS)

In LPoS, delegation is optional. Token holders can delegate validation rights to other token holders without custody, meaning that the tokens remain in the delegators’ wallet. Additionally, only the validator is penalized in case of security fault (e.g. double-endorsing or double-baking). LPoS also offer voting rights, except that as a token holder, if you operate your own baker, you get to vote directly in the protocol amendments, and not only in who secures the network like in DPoS.

LPoS was first introduced by Tezos, an on-chain governance protocol, created by Kathleen and Arthur Breitman, which has been running smoothly in mainnet since September 2018. LPoS in Tezos has proven to be very successful, with a current stake rate of approximately 80% spread across 450 validators and 10,000+ delegators. The number of delegators is technically limited by the bond size minimum requirement, and with current parameters could go up to around 100,000 — Great decentralization 🏆.

Bonded Proof-of-Stake (BPoS)

BPoS is very similar to LPoS: delegation is optional, non-custodial, and token holders benefit from voting rights in protocol amendments. Although, there is a reason why it is called BPoS: in case of safety or liveness fault, a portion of the validators and delegators’ stake will be slashed. In LPoS, only the validator is at risk of slashing, while the delegators only risk is to miss on some rewards/interests in case its validator is dishonest or not efficient.

This BPoS mechanism has the advantage of providing a clear solution to the issue of staking ratios (similar to capital requirements) that some validators on LPoS protocols have to maintain if they do not want to become over-delegated and disappoint some of their delegators. While it solves this issue, it also means that delegators need to conduct extra due diligence before delegating, and remain active in verifying the performance of their validator.

BPoS was first introduced by projects such as Cosmos and IRISnet (which build on the Cosmos SDK / Tendermint). Both are very interesting inter-chain protocols to have a look at 🚀. We’ve written a short introduction to IRISnet if you are curious. In BPoS protocols such as Cosmos and IRISnet, there will be a limited number of validators, starting at 100, with selection based on the size of their total stake (own stake + delegations).

Nominated Proof-of-Stake

The Polkadot ecosystem has introduced Nominated Proof-of-Stake (NPoS). It is now used by many Substrate-based chains such as Polkadot, Kusama, or Edgeware. In this system, validators get selected automatically a couple of times per day. These validators need to run costly operations such as ensuring high communication responsiveness, building a long-term reputation of reliability, and stake their native token. They do this as safekeeping for good behavior, their stake gets slashed whenever they deviate from their protocol. And slashing can happen very fast on NPoS, as illustrated by the recent Edgeware validator outage.

In NPoS, delegators are called nominators. A nominator nominates validators among a list of candidates and locks-up an amount of staked tokens to support them with. In NPoS, the number of validators is limited by governance, and these are selected based on their total stake in the network. Unlike the validators, an unlimited number of parties can be nominators. Nominators have an incentive to continuously be on the lookout for solid new candidates. With these two roles, NPoS allows for all token holders to participate continuously in the network. Therefore, they maintain a high level of security, while keeping the number of validators bounded.

Hybrid Proof-of-Stake (HPoS)

Hybrid PoS/PoW is often referred to as a mix between Proof-of-Work and Proof-of-Stake. It is a way to secure the network using both of these methods: the PoS works alongside the PoW system to further secure the blockchain. Usually, in such implementation, miners produce new blocks via PoW, and PoS validators then vote on the validity of these. HPoS provides a superior deterrent to majority attacks by augmenting hashing power with stakeholder voting.

Among the projects working on HPoS, we can name Decred and Hcash. Ethereum is also looking at HPoS for its Casper upgrade. In Decred, token holders have the ability to check the blocks found by miners and to vote on changes to the consensus rules.

Pure Proof-of-Stake

Another consensus algorithm introduced by Algorand is Pure Proof-of-Stake, which is a protocol with open participation, scalability, security, and transaction finality. In this algorithm, the network ties its security to the honesty of the majority.

What’s different about this algorithm is that unlike the before mentioned DPoS, LPoS, or BPoS, there are no sanction mechanisms for the case an entity misbehaves. Instead of slashing bad actors, the network prefers to make cheating by a minority of the money impossible and cheating with a majority, simply stupid. The protocol is developed in a way that as long as 75% of the majority in the network is honest, it will continue to work fine.

Leased Proof-of-Stake

Leased Proof-of-Stake is a direct variation of PoS. When using this consensus protocol, leaders can participate in the process of generating new blocks. The reason for this is that the more significant the amount that is leased within the network’s nodes, the higher the chance that it will be selected to create the next block.

LPoS transactions work as follows — to be able to start leasing, the token holder needs to create a lease transaction and specify the address along with the number of tokens they want to lease. A network that has adopted LPoS is the Waves Platform.

Others That Can Be Assimilated to PoS

Our goal in this article is to provide you with an overall overview and keys to understand the various PoS protocols. As PoS is gaining interest across the overall blockchain industry, we would like to mention some other projects that also offer to stake, although with their own variant:

- Tomochain: Proof-of-Stake Voting (PoSV)

- Dash: Masternode staking

- Ontology: Delegated Byzantine Fault Tolerance with ONG “dividends”

- Neo: Delegated Byzantine Fault Tolerance with GAS “dividends”

A Quick Overview Table

Conclusion

We believe that we will see more variants of Proof-of-Stake emerge in the future as the creativity of the talent pool working behind blockchain is quasi-infinite. It has now become clearer that PoS cannot be ignored as one of the best tested and viable alternatives to other consensus mechanisms such as PoW. With the rise of PoS, a multitude of staking-as-a-service providers is also emerging, and we recommend that you, as a token holder, do not miss out on your interests: taking into account compounding, these can increase pretty fast. If you are looking for a trusted validator, we’ll be more than happy to advise you and help you earn rewards on your crypto holdings. Feel free to reach out to us, we are Stakin.

Join the conversation