A deep dive into non-fungible tokens – what they are, and how they came about

Non-fungible tokens (NFTs) seem to be everywhere, going from something utterly unheard of to a significant brand investment. It has taken the digital art and collectibles world by storm, from art and music to sports and toilet paper.

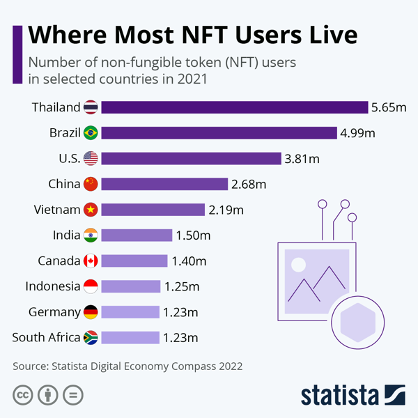

Although NFTs have been around since 2014 with Quantum, they went mainstream in 2021 as a means to buy and sell digital artwork. Ever since, these digital assets have been trading like 17th-century Dutch Tulips, with a total market surpassing from $200 million in 2020 to $40 billion in 2021. NFTs have gained significant adoption among East and Southeast Asian countries, including Thailand, China, and Vietnam, according to the Statista Digital Economy Compass 2022. However, one question remains: are NFT’s overpriced digital art or a promising technology that could transform the way we live?

Some believe NFTs are here to stay, to push our minds to think differently. With so many untested applications, we have only scratched the surface regarding their potential — everything is still early and experimental.

NFTs can take the form of digital art, virtual land, a domain name, an item in a video game, and so much more. It is a technological medium that allows any digital item to be circulated virtually. NFTs are stored on the blockchain, a decentralized token that can be traded peer-to-peer. If you uninstall your wallet, the NFT will still exist on the blockchain. When you buy an NFT, you can verify its origin, author, and metadata on any block browser.

Digital artists are seeing their lives change thanks to massive sales to a new crypto-audience. Even celebrities are joining in as they spot a unique opportunity to connect with fans.

What’s an NFT?

NFTs are tokens we can use to represent ownership of a unique item. With it, we can tokenize things like art, collectibles, real estate, licensing of digital music, and much more. Notably, an NFT can only have one official owner at a time, and the blockchain secures them.

NFT stands for non-fungible token. Non-fungible means it’s unique and can’t be replaced with something else. A bitcoin is fungible; trade one for another bitcoin, and you’ll have the same thing; no value is forfeited. On the other hand, something as art is generally non-fungible. “The Starry Night” is not equal in value to the “Mona Lisa’’, as they are both unique.

By establishing a distinctive digital signature that identifies the ownership of your assets and allows for their purchase and sale for fiat or cryptocurrency, NFT makes your digital assets one of a kind. Ultimately, they are programmable collectibles that can have unique features. Each NFT contained distinguishable information, like who owns the digital asset and sold it, making them distinct and easily verifiable.

It’s the story of human psychology: technology has caused a shift in how we value things, with the potential to revolutionize how we live.

While some may be enthusiastic about collective digital images for their aesthetic, others are more captivated by the utility of unique tokens offering real-world benefits. Utility NFTs are NFTs with use cases beyond just being unique digital art. They are NFTs that grant their owners privileges, rights, or rewards they would not otherwise have access to.

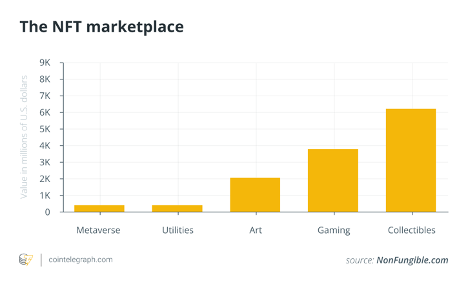

Since the beginning of 2021, transaction volume has skyrocketed. After an increase of that magnitude, it seems it has begun to stabilize. Despite the market conditions, as of May 1, overall, collectors have sent over USD$37 billion to the NFT marketplace. A number that is closely reaching the total of 2021. With a single sale of US$2.6 million for CryptoPunks NFT #4464. CryptoPunks is one of the most valuable and successful NFT projects, created in 2017 by Larva Labs. Even Visa has joined the bandwagon and purchased their own.

However, the Bored Ape Yacht Club (BAYC) by Yuga Labs is a rising prominence. They represent more than just the original image itself. BAYC is an exclusive community for holders, and perks have been sizable. Holders have received free airdrops from NFT projects valued at five figures, exclusive merchandise, and access to special events. Other opportunities are being tested, such as licensing commercial rights to their ape illustrations.

By creating an actual use case, not just viral images, BAYC delivers value to its holders beyond the speculative price.

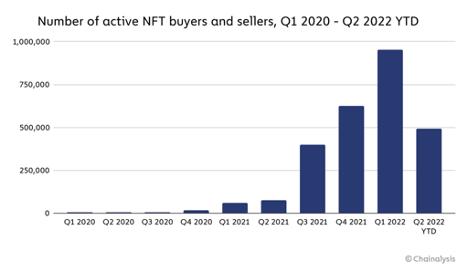

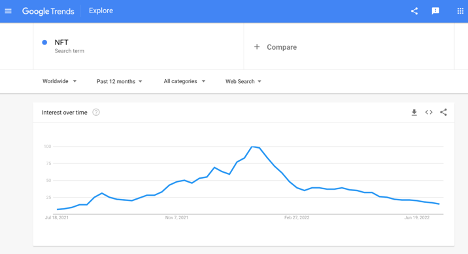

Even the BAYC is not immune to market conditions, with floor price falling below USD$100,000, down 78% since late April when it was valued at USD$429,000. A series of conditions have brought the NFT value down, such as a general decrease in the hype (as per Google Trends), the market’s recent downturn, fear of scams, and rising inflation rate resulting in users being less inclined to undertake risky investments. The data shows a rapid drop in unique buyers, from over 900k in Q1 2022 to nearly 500k in Q2 2022.

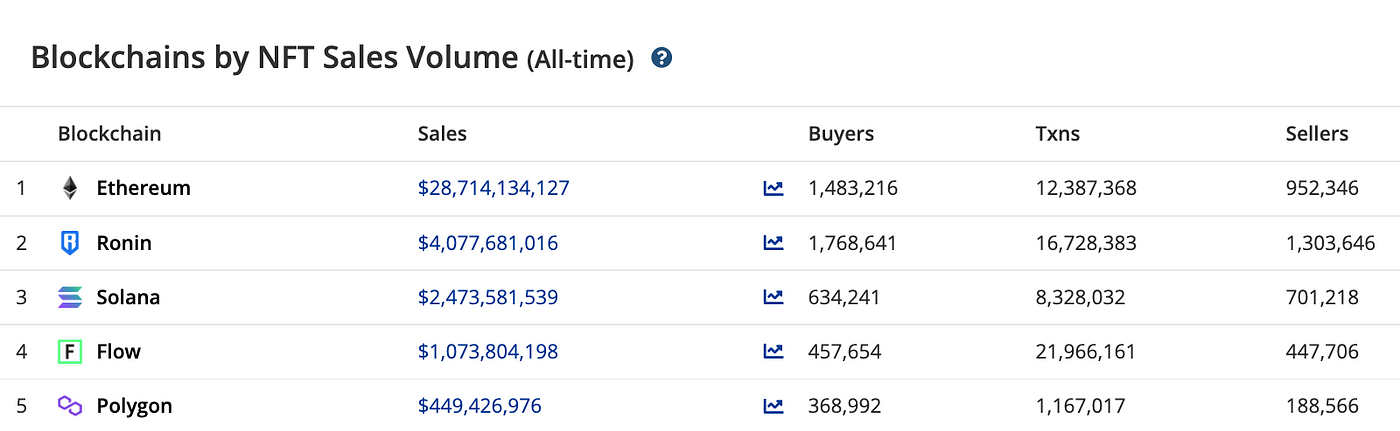

In terms of all-time NFT sales volume, Ethereum stands apart, with USD$28 billion, followed by Ronin, home of Axie Infinity, with USD$4 billion, and Solana with USD$2.4 billion. It is worth noting, as Ethereum is the largest network, it suffers from congestion which in turn creates high gas fees.

NFT adoption in Southeast Asia has been linked, most notably the popularized play-to-earn game Axie Infinity by the Vietnamese company Sky Mavis which runs on the Ronin network. Axie Infinity saw USD$3.5 billion in NFT transactions in 2021 alone; as of February, it reached USD$4 billion, becoming the most traded NFT collection. Despite the market downtrend and the massive Ronin bridge hack, crypto’s biggest game appears to be showing a renewed sign of life.

The web traffic of the significant NFT marketplaces shows that NFT attracts users from all corners of the globe, with Central and Southern Asia leading the charge, followed closely by North America and Western Europe.

Beneath all the hype and speculation, it appears that the future of NFT will be about utility or use cases, not just art. Beyond proving ownership of a unique digital asset, this technology has almost limitless applications beyond simple pixelated art. To date, the utility has tended to include anything from merchandise, access to unique communities or events, and promising future airdrops.

Nowadays, you can also earn passive income by staking NFTs, making them more attractive to buyers. NFTs are tokenized assets; it’s like staking your cryptocurrency in DeFi. In addition, there are also staking platforms that have decentralized autonomous organizations (DAOs). DAOs allow users to participate in governance; this includes voting on proposals that can potentially shift the project’s direction.

NFTs can potentially disrupt many industries by increasing the security of transactions. Take real estate; one of the downsides of investing in this sector is the hassle of transferring property ownership. With an NFT, the process is streamlined, allowing the buyer to assume ownership within minutes. Imagine now that buyers can borrow against the NFT using decentralized finance (DeFi) products on the blockchain, skipping the arduous due diligence required by most big banks when taking out a mortgage.

Another potential use case is in medical records; the technology holds immense potential to reshape patients’ control over their medical information and allow them to track biological samples taken from their bodies. From healthcare and identity to real estate and art verification, the endless possibilities of NFTs are just starting to show.

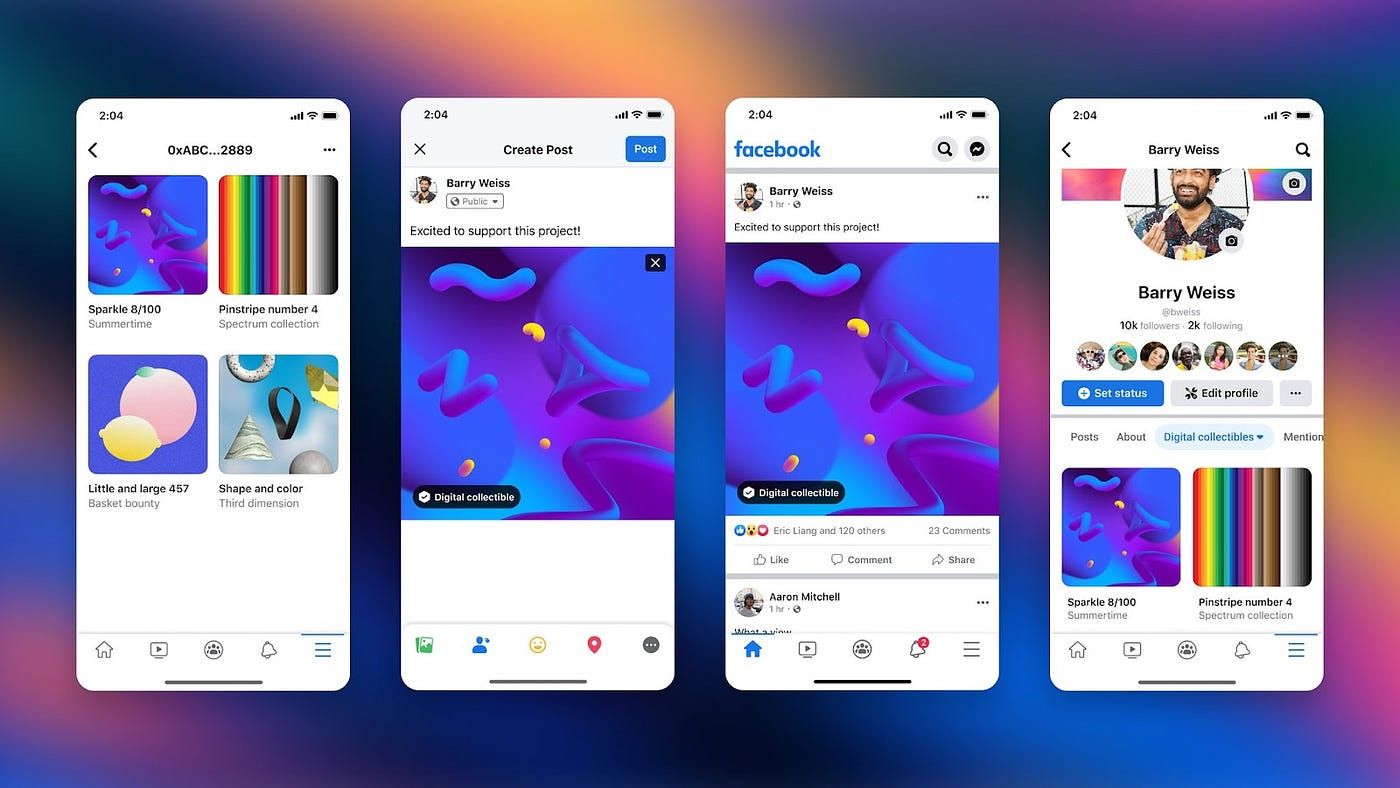

Polygon, the Ethereum scaling solution, has constantly been in the headlines as a vehicle the biggest tech companies use to make their debut in the market. The collaboration spans Reddit, eBay, Meta, and more. Meta, with a user base in the billions, has rolled out testing for NFTs on Facebook and Instagram to a handful of users. The paradigm has shifted from web3 taking over web2 towards web2 embracing web3 and becoming its interface or gateway.

Many projects have found a home in Polygon, especially after the sudden downfall of the Terra ecosystem, which left a community of innovative NFT projects in limbo. In search of a new home, OnePlanet has taken the lead and built its version of Noah’s Ark called Ark*One to rescue Terra’s promising NFT biodiversity with a total of 48 NFT projects. These include P2E (play-to-earn) metaverse, the A.I. generated NFT universe DystopAI, and some of Terra’s more successful PFP (Profile Picture) collections, Hellcats and Babybulls, among many more.

“This decision to migrate to Polygon comes with extensive research and input from our stakeholders. After many days of meetings and conversations with dozens of foundations and representatives from other blockchains, Polygon became the clear partner as a new home for OnePlanet and the Terra NFT projects that are migrating with us. Taking into consideration the key factors such as mass adoption, market opportunities, stability, and foundation-level support, we found that Polygon is currently the most prominent chain with so many big projects and entities onboarding.” OnePlanet

Onboarding new users into the space has been a significant hurdle. Companies like Paper are working on allowing users to create wallets through their email addresses and purchase NFTs with credit cards across the Polygon, Ethereum, Solana, and other blockchains. They are providing non-crypto consumers a “frictionless” bridge into the market.

Newcomers in the industry should be aware that investing in NFTs is extremely risky. It lies in the bleeding edge of technological innovation; in it lies the frontier of our understanding. Because of its decentralized and unregulated nature, it’s rife with scammers and less than reputable personalities. A rule of thumb is never to invest more than you are willing to lose.

Risks

Be wary of market cycles; last year, NFTs grew with a healthy and bullish crypto market. Today, Bitcoin’s downtrend has had a significant impact on the market. The NFT market is highly volatile; always remember that every investment in this sector can drop to zero. For this reason, it is recommended never to invest more than you are willing to lose.

OpenSea, the world’s first and largest NFT marketplace, is preparing for tough times. On July 14, they announced the company would let go ~20% of its staff. OpenSea joins the slew of prominent crypto companies scaling back headcount during the down market.

An NFT rug pull occurs when the team behind the project doesn’t deliver on their promises after getting investor funds, abandons it, and disappears with investors’ money. Always be diligent before investing and do your own research!

As a global market, clear rules have yet to be established by governments. Regulation could help mitigate market manipulation and protect investors from harmful actors. Safer markets can increase investor confidence, resulting in greater value and stability over time.

One of crypto’s most appealing features is its decentralized nature, which makes every user their own bank. But, with extraordinary power comes great responsibility, meaning that you are responsible for storing and managing your funds. So, if there’s a problem with a transaction because you input the wrong information, the funds will be lost forever.

There has been much talk about the energy consumption utilized by NFTs. Since most of the traffic is handled on Ethereum, a Proof-of-Work, the energy is considerable. However, they plan to soon transition to Proof-of-Stake, dropping the usage by ~99%. If you wish to learn more, check out our Ethereum 2.0 blog post.

Be careful out there; scams are, unfortunately, a common occurrence.

Conclusion

So, how can we prepare for the future of NFTs? Education is critical; without a fundamental understanding of blockchain technology and NFTs, it will be difficult to understand the potential it can deliver.

It’s pushing our minds to think differently about how we validate or verify things. If I buy a house, there is a long, arduous process with many intermediaries to validate the transaction. A nightmare of an experience, if suddenly a technology came that took away the centralized process and made transactions between people able to be authenticated, verifiable, and much smoother, that could change our world.

It’s a universe of opportunities that we continue to explore and understand, especially for the 2 billion people around the globe without access to financial services where they can’t necessarily rely on a robust legal system to protect their ownership rights.

The future of NFTs goes beyond social status, memes, or multimillion-dollar works of art tuned profile pictures. We are just getting our heads around what this technology can mean, and eventually, we will adapt and transform the world around us.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

About Stakin

Stakin is an infrastructure operator for Proof-of-Stake (PoS) public blockchains, offering noncustodial delegation services. The company enables PoS cryptocurrency holders to earn interests on their holdings and participate in decentralized governance while remaining in possession of their cryptocurrencies.

Stakin serves institutional crypto players, foundations, custodians, exchanges as well as a large community of retail token holders. Driven by demand from institutional customers and the community, Stakin provides services for multiple blockchains, including leading ecosystems such as Cosmos, Solana, Polygon, Polkadot, and more.

For more information about Stakin, visit the Website, Twitter, Blog, or join the Telegram and Discord community.

Join the conversation