Kava votes on the kick-off for its Surge Program. The program was announced to celebrate the successful launch of Kava 9 and the networks’ IBC integration.

As a Layer-1 blockchain, The Kava blockchain combines the two most used permissionless ecosystems — Ethereum and Cosmos — into a single, scalable network using a developer-optimized co-chain architecture. The protocol offers a DeFi platform for multi-collateralized loans and stable coins for crypto assets.

Since its materialization, the Kava blockchain has expanded itself and works on continuous growth. It has different infrastructure projects like the Akash Network, multiple cross-chain bridges, DeFi apps, insurance apps, wallets, and more.

A Proof-of-Stake Tendermint-based consensus mechanism and the native asset $KAVA have been created to power the Kava ecosystem. Every $KAVA holder can delegate their assets to Kava Validators, thus ensuring the security of the network and earning rewards.

- You can learn more about Kava and how to delegate Kava tokens using TrustWallet or Cosmostation in our article here.

The Kava Surge Program — What’s It About?

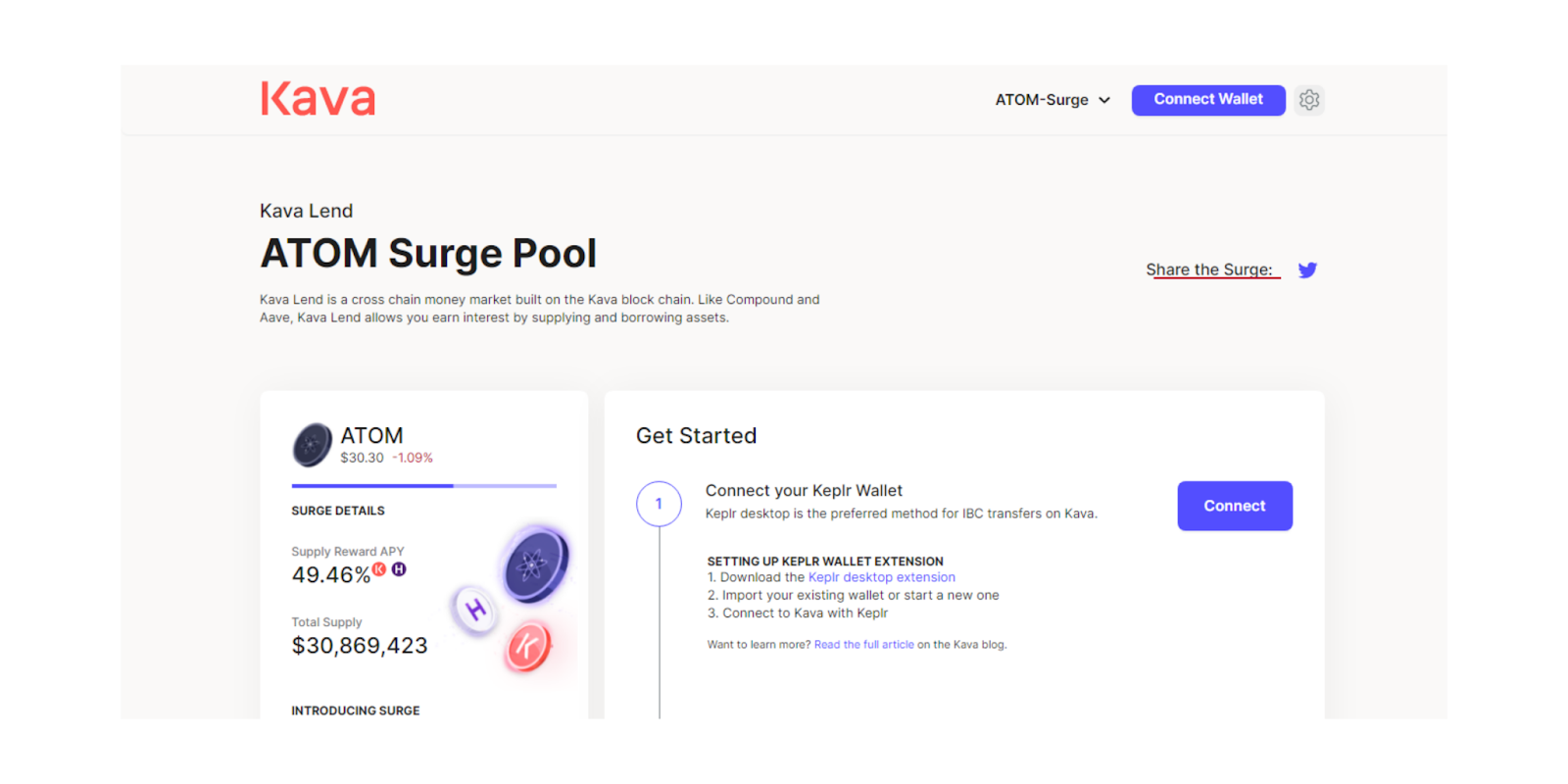

The Kava Surge Program lets liquidity providers in Kava Swap enhance their yield opportunities. Each Surge event boosts the APYs for newly added IBC assets in Kava Lend.

- Participant pairs are $ATOM, $AKT, $LUNA, $OSMO, and $UST with $USDX.

So, how does it work? Well, the Kava community submitted a proposal to create $USDX pairs with $ATOM, $AKT, $LUNA, $OSMO, and $UST. This proposal was voted on by $SWP holders exclusively and agreed upon.

The $SWP rewards for the Kava Surge event are (/to be) reallocated evenly from the existing pools so that their reward APYs remain competitive. The main goal of this is to attract fresh liquidity into the ecosystem and offer users a better onboarding experience while generating higher yields with their assets. All rewards earned are locked on the 1 or 12-month vesting schedules.

Now, that leaves the question: how long will the Kava Surge last?

There is no timeline for the Surge event. Each Surge lasts for at least one month, and $SWP holders will have the ability to vote on other proposals for adding new pairs.

After supplying their assets, liquidity providers will start earning rewards.

Early liquidity providers can earn rewards up to 2,700% APY during the Surge; the earlier you get into the Surge, the better, as rewards will reduce as more people supply liquidity to the pools.

How to Participate in The Kava Surge Event

First, go to the Kava app here.

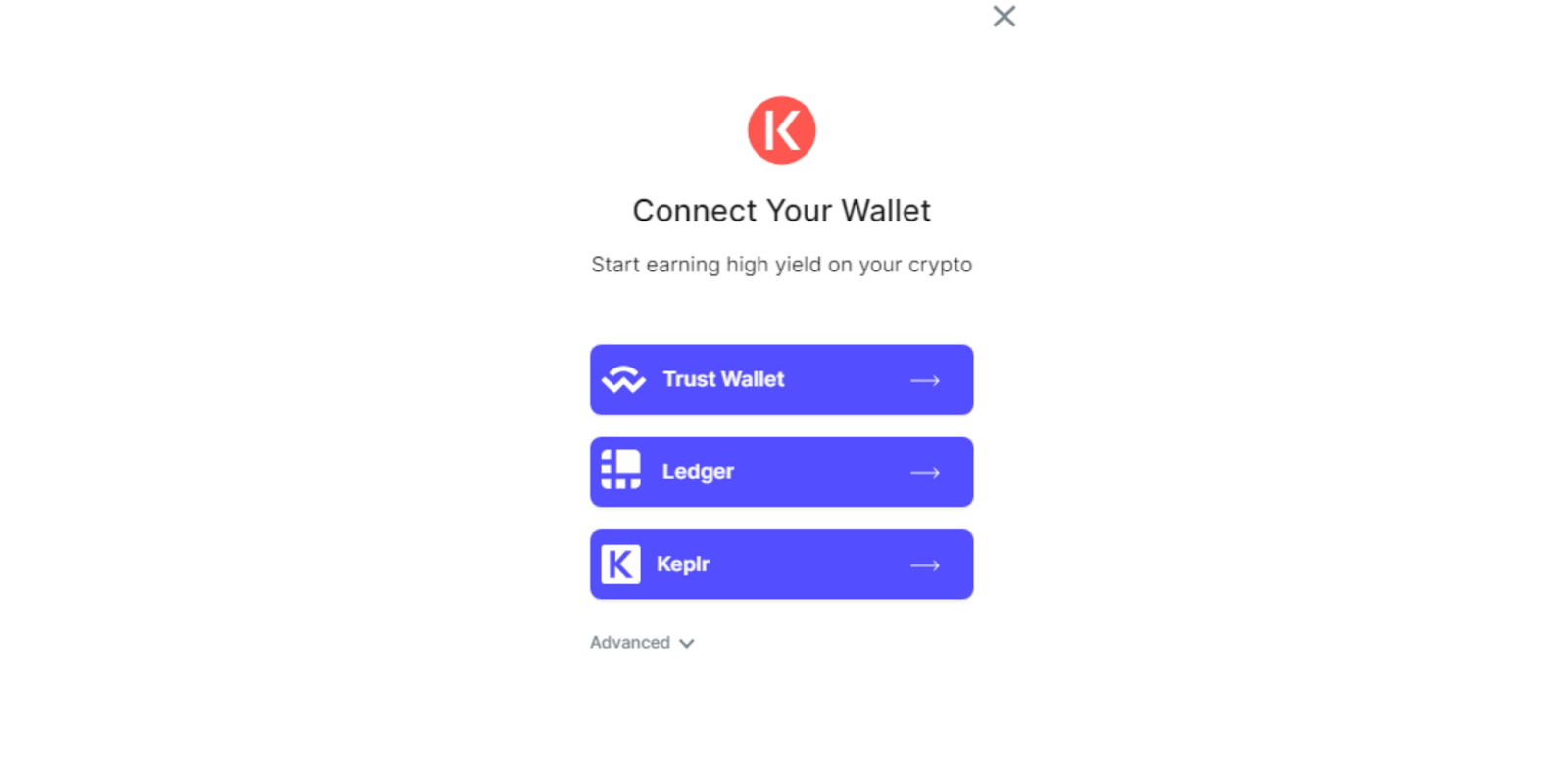

Connect your Keplr wallet with the Kava site. It gives you the option to connect Ledger and Trust Wallet, you can review our guide on how to stake Kava using Trust Wallet here.

After that, the second option you will see is “Deposit” Click on it to load your Kava account.

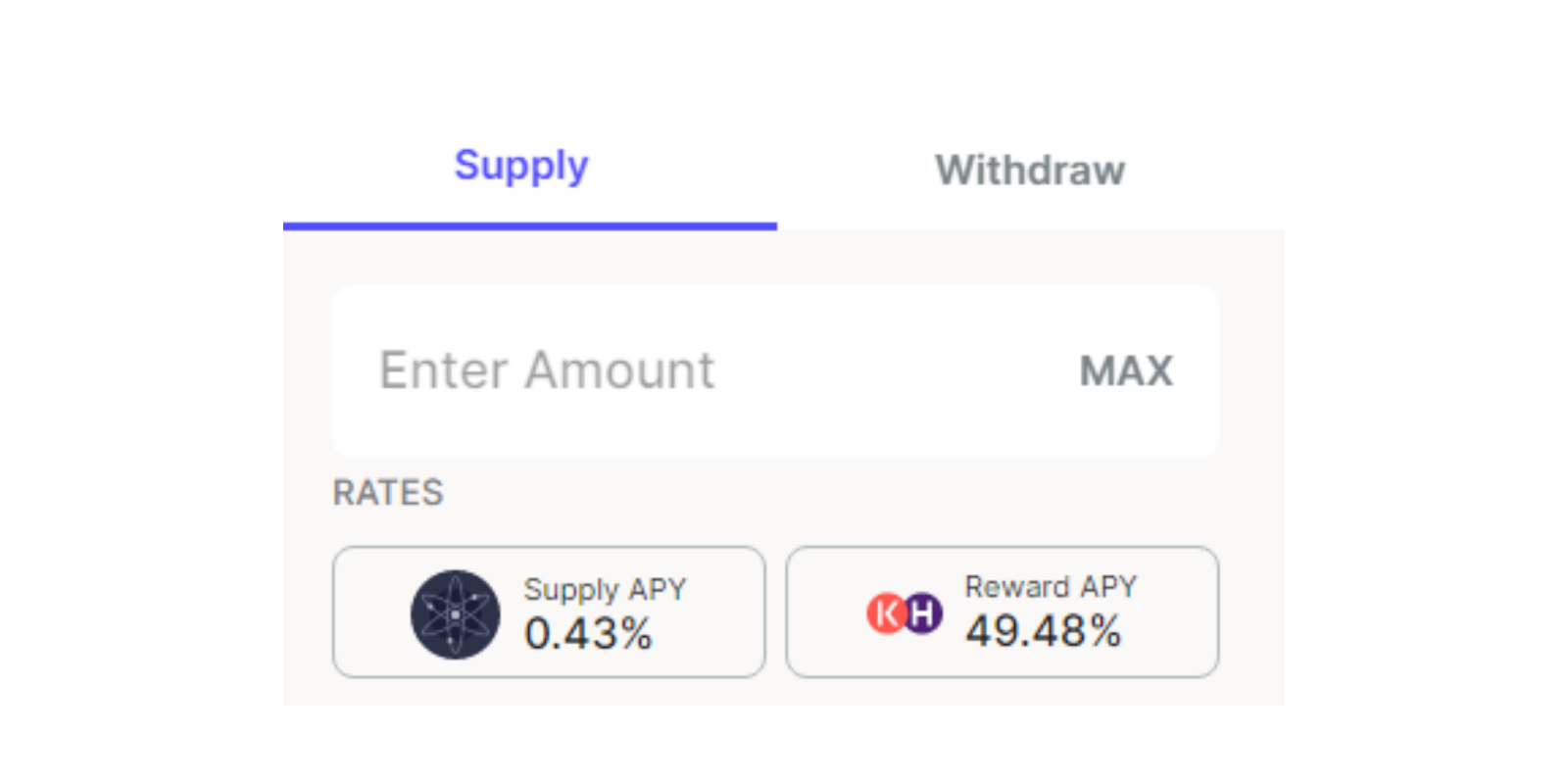

Once the deposit is completed, you will be able to supply your assets to the protocol for lending. For that, click on “Supply” to see the balance available to supply plus the rates, as shown in the image below:

Once confirmed, that’s it; besides that, you can add liquidity to your favorite Kava Swap pools and claim your rewards anytime.

Kava Swap is a decentralized cross-chain Automated Market Making (AMM) protocol. It supports low fees, and high-speed transactions and generates great returns for liquidity providers.

- Start Earning: https://app.kava.io/swap/pools

Follow Kava on Twitter

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.