Everything you need to know to be able to understand and start staking.

Hi Readers👩💻,

Today’s article will be a bit more for the new blockchain enthusiasts, like me. Did you know that it is possible to earn a passive income with staking? In this article, we’ll tell you everything you want to know to be able to understand and start staking.

💻 PART 1 — About Staking

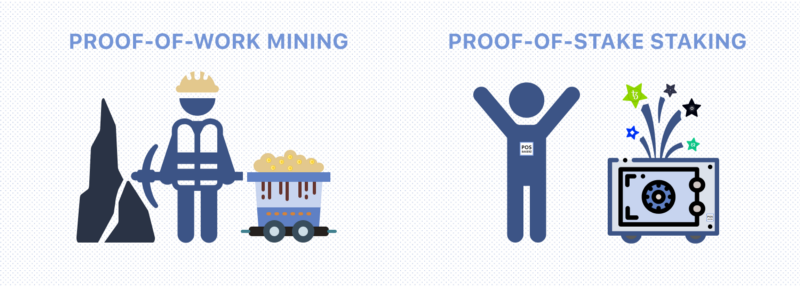

To be able to comprehend staking, you first need to know about Proof-of-Stake and Proof-of-Work. While we are aware that we’ve discussed this subject before, here is a quick summary.

- ⛏ Proof-of-Work (PoW) is a consensus mechanism used to decide which blockchain network users are eligible to create a new block. For an entity to be selected and able to choose the next block, they’ll have to solve a particular mathematical problem.

- 💼 Proof-of-Stake (PoS) is another consensus mechanism to determine which users get to create new blocks on the blockchain. With this method, you don’t need to solve a mathematical problem, and thus, you’ll need less computing power and energy. New block creators are selected by the amount of wealth they’ve locked-up in the network.

An often asked question is if PoS is more secure then PoW. Even though every blockchain network is different and has its level of risk, a common chance with a blockchain is the 51% attack; this poses a hypothetical situation in which miners with more than 50% of the computational power of PoW blockchains would permanently own the blockchain. And thus be able to change transactions and have the possibility to double-spend cryptocurrencies. Now, that’s not something anyone would want to happen since this destroys the fundamentals of the blockchain.

For PoW systems, for such an attack to occur, miners would need to have more than 50% of computational power (and a lot of hardware), so we could say that this is almost impossible. For a 51% attack to happen on PoS systems, someone would need to own over 50% of all available tokens. With most systems having large market capitalizations in the millions of dollars, we could also say that this is near to impossible. Furthermore, buying assets from a network inflates the price of the token. If you’d to try and buy half a network worth of symbols, it would eventually just become too expensive. Plus, once you’d own most of the network, you don’t have the interest to attack it since your ownership would lose value as well. And so, in this aspect, PoS could be considered more secure.

✅ Benefits of Staking

So, why would you stake your crypto assets? Staking cryptocurrencies offers several advantages. First, staking your assets through PoS avoids being diluted by inflation. Nonetheless, the value of your staked tokens can be affected by fluctuations in the currency price.

Furthermore, a significant benefit of staking digital assets is that it doesn’t require expensive hardware, which makes it more accessible to a broad public. Thirdly, staking offers a quasi-guaranteed return and a predictable source of income when measured in tokens. Also, it is more environmentally friendly to invest in PoS because it doesn’t require high amounts of energy, like with mining in PoW networks.

🔻 Risks of Staking

As with any investment, staking cryptocurrencies isn’t risk-free. So, let’s go over the risks involved.

First, there is the possibility of Slashing; this means your validator or baker can receive punishment for a fault conducted. This mechanism is designed to discourage abnormal behavior. The second, and probably most crucial risk, is crypto volatility, which means that some cryptocurrencies exposed to rapid and unexpected change. If it’s for the better, these changes can be helpful and very profitable. However, the downside is that it can depreciate the price of your tokens too much, leaving you empty-handed.

- For more information on how you can deal with, and reduce staking risks, check out our article here.

👨💼 PART 2 — Step-by-Step Staking

Now that you know about Proof-of-Stake, risks, and the benefits of staking cryptocurrencies, it’s time to get into how to stake. We’ll take you through it, step-by-step.

- First and foremost, figure out what digital assets you want to stake. Remember, it is always essential to do your research. To get to know more about our favorite cryptocurrencies for staking, find the article here.

- What are the requirements to start? Some blockchain ecosystems have a minimum amount of tokens that you need to have before you can start staking.

- Select the wallet you want to use for staking. There are many different wallets available; some very well-known ones are Trust Wallet and Atomic Wallet. A staking wallet works a bit like a traditional bank account. You’ll have to download one of your choosing. Some tokens, such as the one of the ICON Network, ICX, have their staking wallet, which you can download directly from the network site.

- Network and hardware access. Most token staking schemes require you to be online 24/7, which means you’d have to have the software and hardware set-up to do so. If you don’t have the capacity to set-up a resilient infrastructure to run 24/7 and to monitor it (we all got to sleep, right), you can choose to delegate your tokens.

- Once you have everything set-up, you’re now ready to get started with staking your cryptocurrencies. For those of you who’d like to have a step-by-step of a specific crypto process, these are the ones we’ve created articles on so far: Staking Tezos, Staking ATOM, Staking ICX, Staking KAVA, Staking LUNA, and Staking IRIS.

🤓 Delegating Your Cryptocurrencies

If you don’t have the required time, skills, or capital needed to start staking, don’t despair. It is still possible to earn a passive income from staking. All you have to do is find a Staking-as-a-Service company, like POSBakerz, that will redistribute their rewards. The safest way to find a good and trusted operator is by using a 3rd party website, such as Staking Rewards. Using an operator to help you stake, is called delegating.

🕵️♂️ Conclusion

There are many reasons why it would be attractive to start staking cryptocurrencies. However, before you get started, do your research. It will guarantee that you find the right currencies, wallet, and operator for your needs. Always search for 3rd parties and reviews when researching a cryptocurrency or operator. We hope this guide has made the concept of staking more clear for you, and we wish you happy staking!

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation