Stakin's Guide To Understanding Chainlink Price Feed Oracles

Recently, Stakin announced that we have joined the Chainlink Network as a node operator, enabling us to play a significant role in expanding the fast-growing smart contract economy. Because we’re very excited about this development, we thought this would be an excellent opportunity to share more information about Chainlink, such as its Price Feeds, its oracle solutions for DeFi, and more.

So, let’s start from the beginning. Chainlink or the Chainlink Network is a decentralized oracle network that provides data and information from off-chain sources to on-chain blockchain smart contracts via oracle nodes. By featuring multiple layers of aggregation, along with highly secure hardware, Chainlink eliminates the single points of failure found in many other oracle solutions.

What Are Blockchain Oracles?

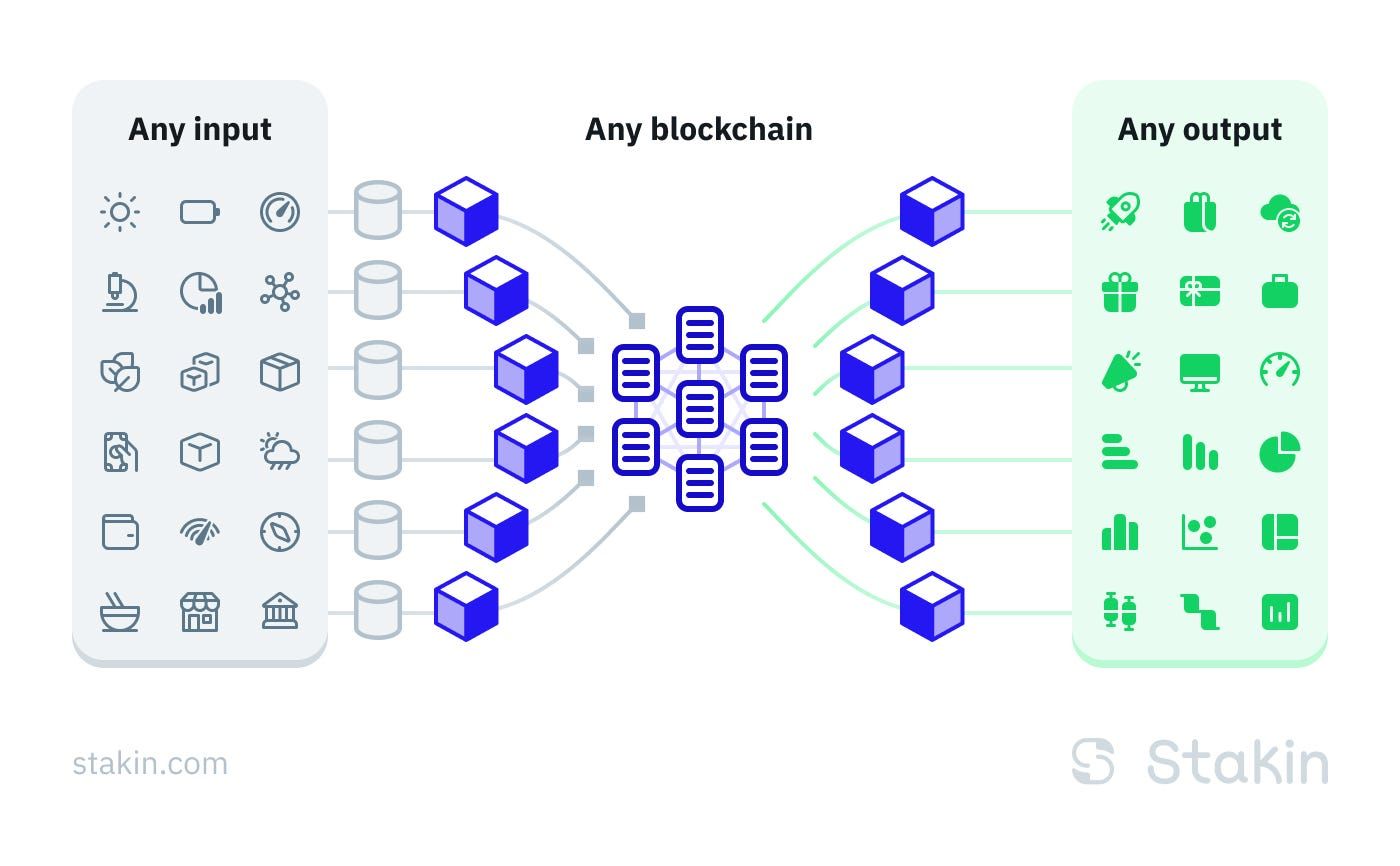

Now, for those who are less familiar with blockchain technology, you might wonder: “What is a Blockchain Oracle?”. Blockchain oracles are services that connect blockchains to off-chain computation, real-world data, or external systems, enabling smart contracts to execute based on input and output from the off-chain world.

Chainlink oracles enable the decentralized Web 3.0 ecosystem to access existing Web 2.0 data sources, legacy systems, and advanced computations. Chainlink decentralized oracle networks (DONs) enable the creation of hybrid smart contracts, which combine on-chain code and off-chain infrastructure to unlock advanced decentralized applications (dApps) that react to real-world events and interoperate with traditional systems.

It’s important to note that a DON combines multiple independent oracle node operators and multiple reliable data sources to establish end-to-end decentralization. Thus, if one oracle node fails, others will be able to uphold the security and integrity of the network.

Exploring Chainlink Oracle Use Cases

Chainlink oracles are used by smart contract developers to create more advanced decentralized applications across a wider variety of blockchain use cases. There are many use cases for Chainlink oracles. Before we focus on how Stakin participates in the Chainlink Network, let’s first look at some of the most common oracle use cases.

One of the most common and well-known use cases for Chainlink is using its high-quality price data in Decentralized Finance (DeFi) dApps and protocols. Chainlink oracles are used by a large portion of the DeFi ecosystem, enabling developers to access secure, real-world financial data about assets and markets. Decentralized money markets, for example, use Chainlink oracles to determine users' borrowing capacity and determine whether users' positions are undercollateralized and subject to liquidation. Similarly, synthetic asset platforms can use price oracles to tie token values to real-world assets, while automated market makers (AMMs) can use price oracles to help concentrate liquidity at current market prices to improve capital efficiency.

Chainlink also provides companies with secure blockchain middleware that enables them to connect their existing backend systems to any current or future blockchain network. As a result, enterprise systems can read/write to any blockchain while also performing complex logic when deploying assets and data across chains. The Cross-Chain Interoperability Protocol (CCIP) is being built to provide a universal, open standard for developers to build secure services and applications that can send messages, transfer tokens, and initiate actions across multiple networks.

Then, of course, there is the hot topic of blockchain gaming and NFTs. Chainlink oracles enable NFTs to change in appearance, value, or distribution based on external events. Furthermore, Chainlink Verifiable Random Function (VRF) is a tamper-proof random number generator used by projects to assign randomized traits to NFTs or to help select random lucky winners in high-demand NFT drops. Chainlink VRF is also used by on-chain gaming applications to create more engaging and unpredictable gameplay experiences, such as the appearance of random loot boxes or randomized matchmaking during a tournament.

There are also further oracle use cases such as insurance. During claims processing, insurance smart contracts can use real-world data from Chainlink oracles to verify the occurrence of insurable events, allowing access to physical sensors, web APIs, satellite imagery, and legal data. Chainlink oracles can also provide insurance smart contracts with the ability to make claim payouts using other blockchains or traditional payment networks.

Finally, hybrid smart contracts are also advancing environmental sustainability by creating incentives to take part in green practices by utilizing advanced verification techniques to determine the true impact of green initiatives. Chainlink oracles are critical tools for providing environmental data from sensor readings, satellite imagery, and advanced machine learning computation to smart contracts, allowing smart contracts to reward those who practice reforestation or engage in conscious consumption.

Chainlink Price Feeds

Chainlink has positioned itself as a significant player in the DeFi ecosystem through Chainlink Data Feeds. But how do these feeds work? Well, Chainlink Data Feeds are designed as a shared public resource supported by multiple projects to reduce per-user costs. The feeds operate on a pull (synchronous) model, with price updates triggered on a regular cadence (deviation threshold and heartbeat) to keep the price data current without requiring users to monitor and initiate updates. Each price feed update is stored in an on-chain reference contract, allowing smart contracts to fetch the most recent (or historical) price point atomically within a single transaction at any time.

Each Chainlink Data Feed is composed of various oracle nodes that collect market data about a particular asset from off-chain data aggregator APIs. Chainlink Data Feeds are architected in this secure, decentralized way to make sure full market coverage is acquired, prevent manipulation, and of course, avoid downtime.

Final Thoughts

Stakin is excited to be part of the growing group of professional node operators that support the Chainlink Network, and we’re very much looking forward to contributing more in the future.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation