Everything you want to know about the future of the Cosmos Hub, Cosmos Network and ATOM.

The morning after the ATOM 2.0 vision proposal went live, the whitepaper approved by the collective Cosmos community reads: “The vision of the Cosmos Network, as laid out in 2016, has been realized.”. The realization of a secure software stack (Tendermint, IBC, and the SDK) for interconnecting application-specific blockchains has evolved into an ecosystem of sovereign, interoperable communities and an inter-blockchain communication economy (IBC). Interchain security and Liquid Staking technologies are under development. And so, it is time for the next phase of the Cosmos Hub as an infrastructure service platform, and with that comes a new role for $ATOM. The new role for the Cosmos Hub positions the hub as a secure platform for others to build the next generation of interchain-native infrastructure and applications.

“The Cosmos Hub will secure and capitalize ecosystem-critical applications while serving as the port of entry for new Cosmos participants and a coordinating center for the interchain infrastructure and administrative concerns”. - The Cosmos Hub

Now, before we dive into the new specs of the ATOM token economics and what this means for delegators, let’s look at the proposed new vision and its relation to the current Cosmos Stack. Below, you can find the simplified structure of the core functionalities as first published by Cosmos.

As you can see in the image above, the proposed new vision builds on the layered architecture of the Cosmos Hub, beginning with the collaborative effort required to build and maintain the Cosmos Stack. The Hub's Interchain Security and Liquid Staking functionality, which provide a platform for secure economic scaling, are one layer above. On top of this scaling platform, there is a newly proposed layer of Hub-specific functionality: the Interchain Scheduler and the Interchain Allocator, both of which aim to grow a more resilient interchain.

Let’s look at these key features that will be part of the new vision: the Interchain Scheduler and Interchain Allocator, which will be the backbone of interchain growth.

- Interchain Scheduler: is a cross-chain marketplace that offers cross-domain maximum extractable value (MEV) opportunities.

- Interchain Allocator: this is a platform for delegated parties to grow and align ATOM-based markets, facilitating multi-chain trust and coordination.

Aside from the Interchain Scheduler and the Interchain Allocator, a big role will be played by:

- Social Coordination Technology: Tendermint, Cosmos SDK, and IBC DAOs fit right in. A presence on the Cosmos Hub will allow a broader group of stakeholders to fund and control the open-source software.

- Interchain Security: this is the vital foundation to build essential components of the Cosmos Network, and the Cosmos Hub’s Interchain Security environment will be enriched with new capabilities.

- Liquid Staking: Liquidity is critical in the proof of stake economy. Soon there will be a secure infrastructure for premier vendors to issue liquid staking assets.

As a result of these new elements, a readjusted role for ATOM as preferred collateral within the Cosmos Network is created. The Cosmos Hub is transformed into a long-term holder of ecosystem assets, attracting valuable projects to Cosmos. With increasing asset backing and deeper ATOM markets, ATOM stability, liquidity, and the overall attractiveness of ATOM-denominated collateral increases.

It is expected that, as a result, more participants will join the Cosmos Network and integrate. The Cosmos Hub will expand to provide more favorable conditions for life and trade within the Cosmos Network and the interchain.

Liquid Staking

Interchain Security and Liquid Staking create a secure base layer for projects to build and capitalize on valuable interchain utilities. It's vital that the Cosmos Hub ensures that the liquid staking system is as safe and decentralized as possible. A new liquid staking module will allow for the creation of delegation shares and, as a result, liquid-staked assets that can be used cross-chain with acceptable risk and user experience tradeoffs.

Delegation shares enable protocols to price risk accurately while eliminating the need for unbonding before third-party liquid asset issuance. The resulting liquid staking asset can be easily exported over IBC and earn rewards while collaborating with other protocols to extend ATOM's utility across the interchain.

A competitive marketplace for liquid staking provision will improve the consumer experience further, driving protocols to compete on various dimensions, including trust minimization and safety. This cross-chain liquidity market will serve as a catalyst for ATOM deployment across the interchain.

ATOM 2.0

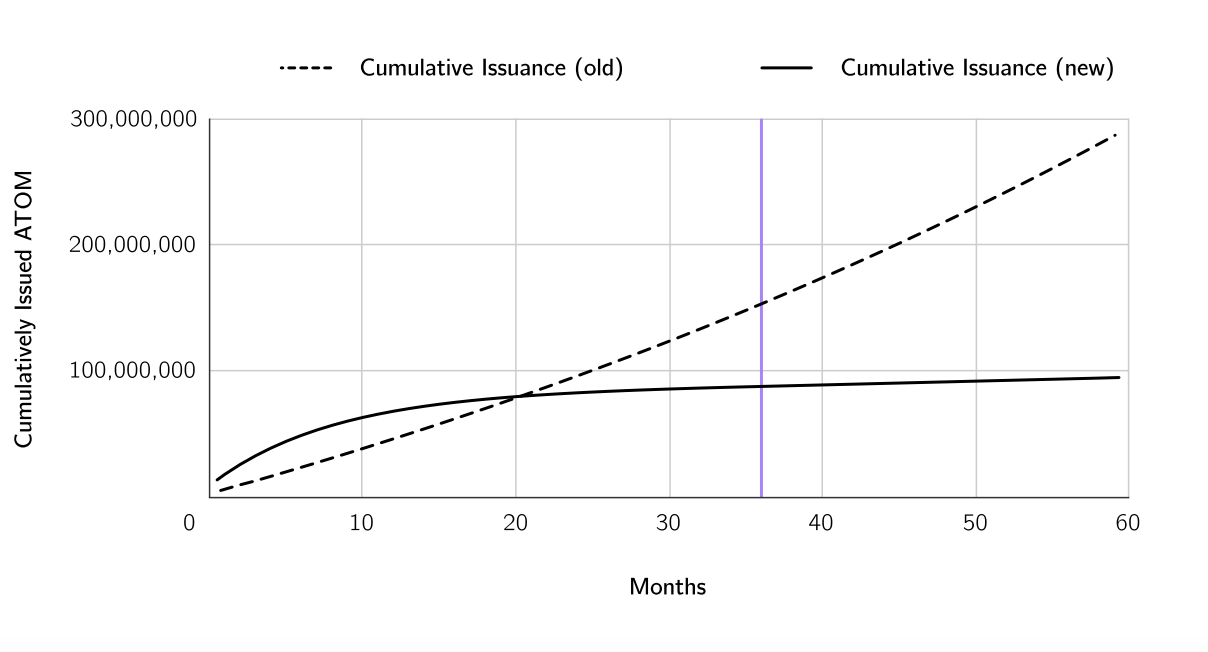

ATOM has a dynamic inflation rate pegged to the bonded ratio, therefore incentivizing staking and securing the network. However, the new design concept is to have a fixed target issuance of 300,000 ATOM per month (which should be replaced by protocol revenue from fees, etc.). The implementation, combined with liquid staking, as mentioned above, will help fund the community pool sustainably and fuel hub-specific functionalities.

However, there will be a 10 million per month ATOM issuance for 9 out of the 36 months during the transition phase (decreasing 10% per month). There will not be any fee burning, but a monetary policy with two phases: transition and steady state, will be in place. The transition phase begins when Cosmos adopts the new monetary policy and lasts 36 months, after which the steady state phase begins and lasts indefinitely.

Final Thoughts

The Cosmos Stack is the industry standard for creating sovereign interoperable blockchains. The Cosmos Hub aims to become the leading platform for scaling IBC-enabled applications, securing foundational infrastructure for the interchain, and accelerating economic coordination for the next chapter of interchain growth with the Scheduler and Allocator systems. Want to dive deeper into the changes to come? Read the full whitepaper here.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation