Get to know everything about the main Proof of Stake protocols, their payout time, lock-up and unbonding time.

Hi Readers 👩💻,

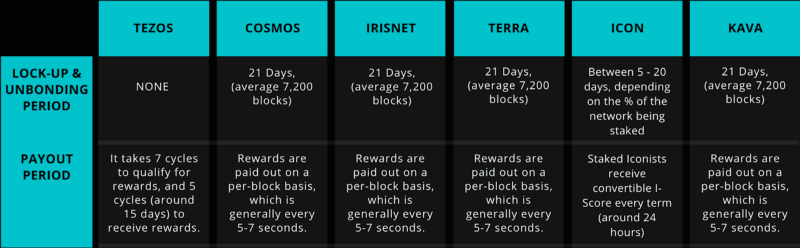

Earlier, we tackled the Centralization of Stake in Proof-of-Stake; see link here. Today we’ve summarized the main Proof-of-Stake protocols, lock-up/unbonding periods, and their pay-out periods. So, let’s take a look.

The Different PoS Protocols

👉Tezos (XTZ)

The Tezos network is based on a Liquid Proof-of-Stake (LPoS) protocol. In this protocol, delegation is optional. Token holders can delegate their validation rights to other token holders, without giving custody. Which means the tokens remain in the delegators’ wallet.

In Tezos, all stakeholders can participate in network upgrades by evaluating, proposing, and approving amendments. The most significant difference in this network is that everyone can help to secure the system (via baking or delegating) and avoid dilution by inflation. Tezos is also unique since smart-contracts on the network can be formally verified, a big plus for security.

📌Cosmos (ATOM)

Cosmos is an ecosystem of blockchains that can scale and interoperate with each other. The Cosmos Hub, the main chain of the ecosystem, has a Bonded Proof-of-Stake protocol. BPoS is a very similar protocol to LPoS. Delegation is optional, non-custodial, and token holders benefit from voting rights in protocol amendments. The difference, however, is that in case of safety or liveness fault, a portion of the validators and delegators’ stake will be slashed. Unlike LPoS, where only validators take this risk.

👁 Irisnet (IRIS)

This network, very similar to Cosmos, is also a Bonded Proof-of-Stake protocol. Irisnet is a public blockchain build on Cosmos and could become the equivalent of the Cosmos Hub in China and Asia in the future. Additionally, Irisnet to address the integration and collaboration of off-chain computing and resources on a distributed ledger and interoperability of services across chains.

🌙 Terra (LUNA)

The Terra protocol prides itself on facilitating the creation of digital assets that track the value of major fiat currencies. Terra offers price-stable coins aimed at mass adoption. Their stability is achieved by creating mining incentives that are countercyclical to Terra demand. Terra is also a Bonded Proof-of-Stake protocol, but slashing goes further than downtimes or safety. Terra validators also have to contribute to the stablecoins price mechanisms by running an oracle, and governance participation are quasi-mandatory.

🧑🚀 ICON (ICX)

ICON is a DPoC (Delegated Proof of Contribution protocol) which is very similar to DPoS. The ICON Network is aimed at being a decentralized blockchain network to facilitate interoperability between communities of chains. The ultimate goal of this protocol is to become a framework for a web of chains comprising enterprises and organizations.

💡 Kava

The Kava Blockchain is based on Proof-o-Stake; their native token is Kava. In this protocol, tokens help to secure the network, as well as governance of the blockchain by delegation. Furthermore, staked tokens can participate in deciding what types of collater the system supports and how many stablecoins the system should create.

In the table below, you can find the lock-up and unbonding period as well as the payout period of each protocol mentioned above.

Links & Materials

- ICON Website

- Github Icon Network

- ICON Tracker

- Cosmos Website

- Forum Cosmos

- Cosmos, Kava and Irisnet Tracker

- Tezos Website

- Tezos Tracker

- Irisnet Website

- Github Irisnet

- Kava Website

- Github Kava

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the loss of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation