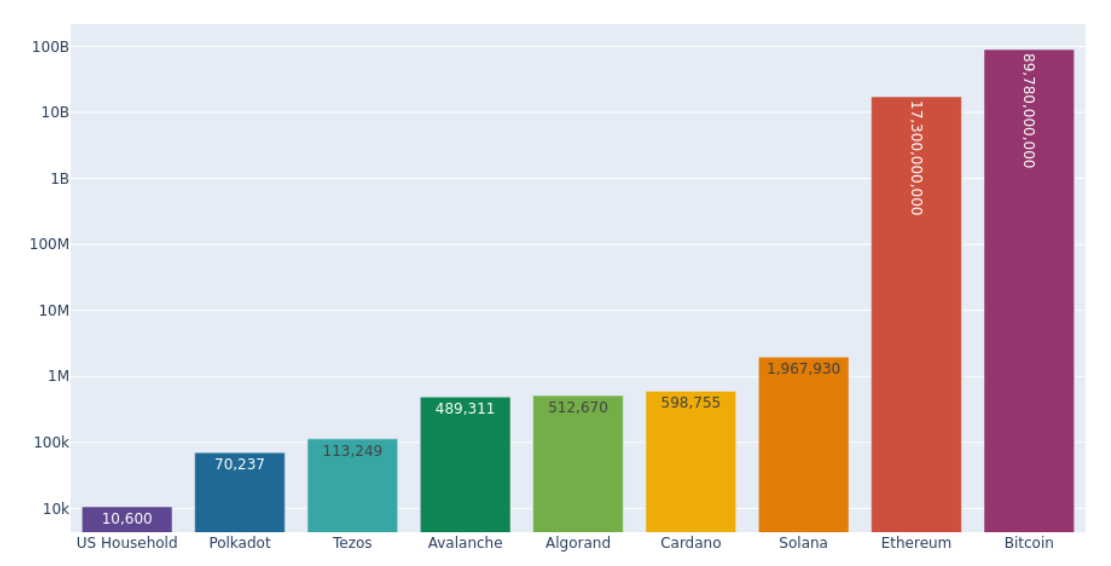

In recent years, cryptocurrency has faced backlash for its high energy use and, therefore, being unsustainable. As the demand for crypto increases among the off-chain and on-chain public alike, the energy use of mining operators (operating on Proof-of-Work) has skyrocketed. It has been estimated that Bitcoin uses ~50-150 TWh of electricty per year, almost as much as countries like Poland or Egypt.

Bitcoin is the main Proof-of-Work network. Virtual miners who compete with computing power to solve challenging mathematical puzzles are the central component of this mechanism. The first miner to find a solution receives a fixed amount of cryptocurrency in exchange for updating the blockchain with the most recent verified transactions. The process requires an enormous amount of computer power and electricity. And there’s also a less talked about aspect: the electronic waste generated from the specialized hardware and computer servers used for mining, which tends to have a limited obsolescence period.

Because of this - among other reasons - Ethereum has activated the Merge to switch from PoW to a Proof-of-Stake (PoS) consensus mechanism. The main difference is that in a PoS consensus system, a network of "validators" contribute or "stake" digital assets in exchange for the chance to validate the new transaction, update the blockchain, and earn a reward. The network employs an algorithm to choose a winner based on the amount of cryptocurrency each validator has in the pool and the length of time it has been there. After the "winner" validates the block of transactions, other validators can attest to its accuracy. The blockchain is updated when a certain number of attestations are received. Then, based on their original stake, all validators who participated receive a reward in the native cryptocurrency. Those unable to run their validator nodes can delegate their digital assets to those who can, enabling a more decentralized consensus system. There are many different PoS consensus mechanism derivatives, which you can learn more about in the link below.

The difference in energy consumption between the two consensus mechanisms is significant. According to Ethereum, the PoS consensus mechanism consumes ~99.95% less energy than the PoW mechanism. Furthermore, the hardware required is less specialized and more akin to a standard laptop, allowing the network to scale and potentially reducing the amount of electronic waste generated. As more and more PoS initiatives arise, more sustainable options and solutions are introduced.

Regenerative Finance in PoS

Within the PoS ecosystem, regenerative finance, or ReFi, has emerged as a new financial structure that takes an approach to finance by focussing on a broader set of social, environmental, and governance investment criteria to determine the worthiness of an investment. Over the last few years, distributed ledger technologies have advanced to the point where real-world use cases are feasible and superior to previous Web2 systems. The regenerative finance space is one of the most potent examples of sustainable innovation currently being unlocked and played out in various ways.

One of the pioneers in this area, Regen Network, has built a blockchain startup focused on ecological data in the regenerative agriculture space and climate-carbon control. The network rethinks agricultural economics so that farmers are seen as land stewards and food producers. Regen Network encourages regenerative land use practices, which help to restore ecosystems and reverse climate change. Reverse climate change and regenerate ecosystems by using digital carbon. Furthermore, validators and other blockchain stakeholders can offset their carbon footprint through their Carbon Credits and support multiple nature projects worldwide.

But Regen Network is not the only Web3 project adopting ReFi; projects like Toucan Protocol are bridging carbon offsets directly from registries such as Verra. To bring carbon on-chain, Toucan Protocol built the Carbon Bridge. It allows anybody to tokenize their carbon credits and make them available in the emerging world of DeFi (Decentralized Finance). The credit can then be tracked to avoid double-spending by bridging the credits from a siloed database on-chain. Furthermore, Toucan can repurpose existing DeFi infrastructure to facilitate the development of new financial products based on carbon credits.

Then there are DAOs (Decentralized Autonomous Organizations) focusing on the PoS and sustainability dilemma. One of the first, BasinDAO, is a global DAO aiming to reduce and remove carbon by restoring and protecting nature and improving human health and wealth. Basin, also known as the "project developer" DAO, works at the real estate level to build and execute climate, nature, and carbon projects with a focus on "core benefits" such as biodiversity, ecosystem services, and climate resilience.

KlimaDAO also focuses on climate offsetting through carbon credits. Built on the energy-efficient Polygon network, KlimaDAO uses a stack of technologies to reduce market fragmentation and accelerate global climate finance delivery to sustainability projects.

- Find more ReFi Projects here: https://refidao.com/.

Closing Thoughts

While Proof-of-Stake and ReFi still have many challenges ahead when it comes to sustainability. The ReFi ecosystems’ incredibly diverse set of projects, protocols, DAOs, scientists, and developers help to build bridges toward a more sustainable future for all stakeholders. With many blockchains such as Polygon and NEAR promising to work on a greener future and offsetting their carbon, we at Stakin are excited to see what brand-new solutions the future holds.

DISCLAIMER: This is not financial advice. Staking, delegation, and cryptocurrencies involve a high degree of risk, and there is always the possibility of loss, including the failure of all staked digital assets. Additionally, delegators are at risk of slashing in case of security or liveness faults on some protocols. We advise you to do your due diligence before choosing a validator.

Join the conversation