One of the more novel applications of DeFi is unlocking illiquid assets, a concept that is becoming increasingly popular, especially with the recent introduction of EigenLayer.

What if there was a way to tap into liquidity that is relatively dormant or held for speculative reasons? Or, what if you don’t have any assets or liquidity but you would still want to participate in generating yield?

That’s where so-called Liquid Staking Derivatives (LSDs) step in. In this article, we’ll highlight the LSDs landscape on Ethereum and analyze some of the key players and adoption metrics.

What are LSDs?

DeFi on Ethereum is rapidly evolving with the introduction of liquid staking derivatives (LSDs). Up until September 2022, Ethereum operated as a Proof of Work (PoW) blockchain, and since the transition to Proof-of-Stake (PoS) we have witnessed a fundamental change.

In PoS networks, validators take on the crucial role previously held by PoW miners to verify transactions. However, becoming a validator requires meeting the threshold of staking 32 ETH, a significant investment at current market prices, thus creating a high barrier to entry.

Liquid Staking Derivatives (LSDs) offer a solution to this challenge, lowering the entry threshold. They not only make participation more accessible but also unlock new market opportunities around the capital that would otherwise remain locked.

Essentially, LSDs represent tokenized IOUs (“I owe you”) issued for staking $ETH through a liquid staking platform. When holders stake their $ETH, they receive these tokens, equivalent in value to their staked $ETH. These tokens automatically accrue yield, which goes directly into the user's wallet, eliminating the need for manual withdrawals, a process required in traditional staking.

LSDs can be used flexibly in various DeFi protocols. Holders can trade them, use them as collateral, or even participate in other DeFi opportunities without missing out on the opportunity to generate passive income from their staked $ETH.

Benefits of LSDs

- Accessibility: Other than lowering the barrier of entry to staking on Ethereum, LSDs provide greater accessibility by enabling a broader range of users to generate passive income without sacrificing liquidity.

- Liquidity and Flexibility: LSDs offer liquidity, a key advantage over traditional staking where staked assets are locked and inaccessible. Participants can use LSDs in various DeFi protocols.

- Automated Yield Accumulation: LSDs accrue yield automatically, which is directly sent to the holder's wallet. This feature simplifies the user experience process and saves on transaction (gas) fees that are otherwise incurred when withdrawing rewards in traditional staking.

- Diversification: The versatility of LSDs allows participants to hold, trade, or use them in different ways, such as collateral for borrowing or depositing into liquidity pools for additional income. This versatility offers a broader range of strategies within the DeFi space.

Potential Drawbacks

- Service Fees: Liquid staking providers typically charge a service fee, which can range from 5 to 10% of the yield. This fee is a cost that participants need to consider when opting for LSDs.

- Market Risks: Like any DeFi instrument, LSDs are subject to market risks. The value of these assets is dependent on the staked assets and the overall market conditions, which can be volatile.

- Complexity: The concept and mechanics of liquid staking derivatives can be complex for newcomers to the blockchain and DeFi space. This complexity might dissuade new users from participating.

- Cartel Formation: Having a large amount of staked $ETH under the control of a single entity can lead to cartel-like behaviors. Not only does this present a security risk to the underlying network, but it can lead to conditions enabling censorship and/or extracting value from the ecosystem.

The Ethereum LSDs Landscape

Now that we’ve covered the basics around LSDs, let’s look at the current Ethereum LSD landscape.

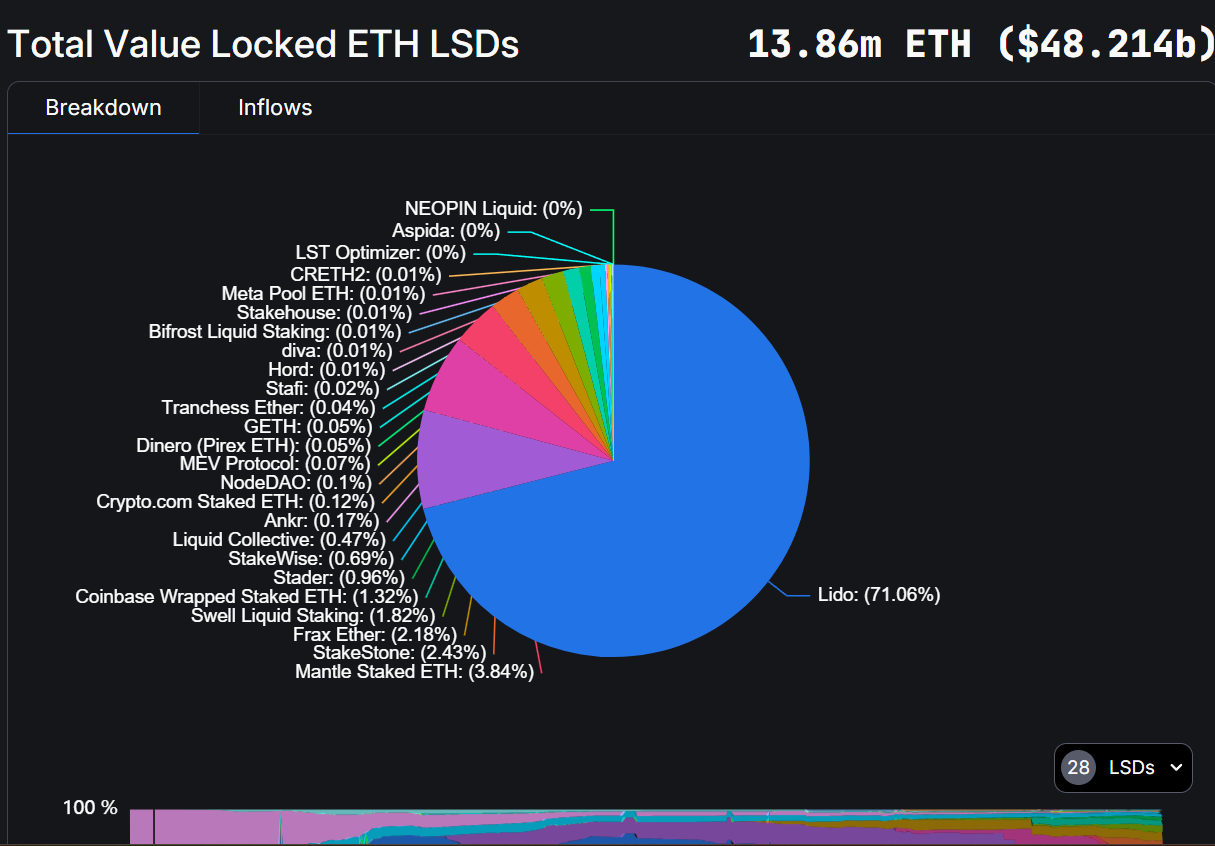

Based on data obtained from DeFi Llama, we can draw a few conclusions from the total value locked (TVL) across Ethereum LSDs as of March 04.

Lido’s dominance amongst other LSDs on Ethereum is apparent. Representing a total of 71.06%, it’s clear Lido has a distinct market share amongst other solutions like Rocket Pool and Frax Ether.

Lido offers decentralized, liquid staking for Ethereum, and Polygon ($MATIC). By staking $ETH or $MATIC, users receive stTokens and generate rewards in real time. Those rewards can then be used across the Ethereum DeFi ecosystem.

Lido has been an early innovator in the liquid staking market, investing substantially in a smooth UX, liquidity, and integrations with ecosystem participants. Lido is also a strong proponent of decentralization, supporting both large and small professional node organizations, and putting the community at the forefront of the protocol through decentralized governance.

The data above clearly demonstrates Lido’s first-mover advantage. Launching in December 2020, just a few weeks after Ethereum 2.0 entered the market has provided a distinct advantage over competitors to follow. Lido’s APR (or, simply put, the interest rate you get on staking your assets) was also quite attractive and currently stands at 3.39% with a 10% protocol fee (March 04 data).

Lido’s fees still represent a smaller portion compared to others like Rocket Pool which has a fixed 14% commission fee for users. While the amount is relatively negligible, it’s worth considering the different options available and how they compare/contrast to one another.

Stakin’s Involvement in the LSDs Ecosystem and Key Players

- Lido

- Stader

- Claystack

- Swell

Let’s dive into the nature and characteristics of key players within the LSDs ecosystem on Ethereum to better understand what they offer and some of their differences. While we’ve already covered Lido, there are a few other key players worth highlighting.

Stader Labs

Stader is a non-custodial, smart contract-driven staking platform designed for PoS networks such as Ethereum, Polygon, Hedera, and others. Stader emphasizes security and partners with major players in the crypto space including Curve, Balancer, OKX, and several others. With Stader, users can receive Ethereum staking and re-staking rewards while retaining liquidity and the ability to participate in DeFi.

Stader is also a strong liquid staking protocol and stands out by allowing node operators on Ethereum to operate for the protocol (although this requires the individual to post a bond).

Claystack

Claystack is a cutting-edge protocol designed to bridge the gap between staking and DeFi. It focuses on maximizing the efficiency of liquid-staked assets, allowing users the freedom to engage in DeFi activities. Focusing on providing a smooth user-friendly experience, Claystack has introduced “Sonic,” a simple and intuitive liquid staking dashboard for users wishing to unstake their liquid-staked assets.

Swell Network

Swell Network is a non-custodial Ethereum liquid staking protocol focused on optimizing yield in the DeFi ecosystem on Curve, Frax, Toros, and several other DeFi protocols. Users can stake ETH and receive swETH in return, which accrues rewards while participating in various DeFi activities. After establishing a Liquid Restaking Council, Swell is actively collaborating to ensure safe and secure liquid re-staking with their upcoming Restaked Swell ETH (rswETH) token.

Join the conversation